How Compound Interest Works and How It Can Help You Save Money

If you are the average millennial, you may not think you need to invest or open a retirement account. Heck, you may not even know where to begin! Whether fortunate or not, Reuters reported in Aug 2020 that openings of tax-efficient self-invested personal pensions (SIPPs) and ISA investments accounts by millennials jumped more than 250% year on year in the second quarter due to lockdown savings.

Question is though, have you started on your investment journey or even opened a retirement account? You probably think it is easier to worry about in five, maybe ten years from now. You are wrong. Time is on your side now, especially with regards to compound interest.

Understanding Compound Interest

No matter your age now is the time to begin saving. The primary way to attain wealth you desire is to spend less than you earn then make money work for you. The wealthy are not wealthy just because they earn a lot of money - they are wealthy because money makes money.

The recipe to become a millionaire is boring, simple and everybody should know it:

It is important to recognise that there is no reliable method for quick riches. There are however proven methods to get rich at a steady pace. If you have both discipline and patience, you can grow a pot of gold that will benefit you later in life. Whilst it may appear that the money you save now could possibly make a difference, I am here to show you the incredible power of compound interest and how this will change your future.

Golden Rule: Earn, Save and Invest!

The best way to build a financial safety net is to start saving today. The amount of money you start with is not nearly as important as getting started early.

What does compound interest have to do with your savings?

Compound interest refers to the principle that when you save money, as well as earning interest on the savings, you also earn interest on the interest itself. Hence, with every passing year, the money in your account you are earning interest on earns interest on each previous year’s interest.

To put it simply, this means not only are your savings growing over time but the rate at which it grows, increases.

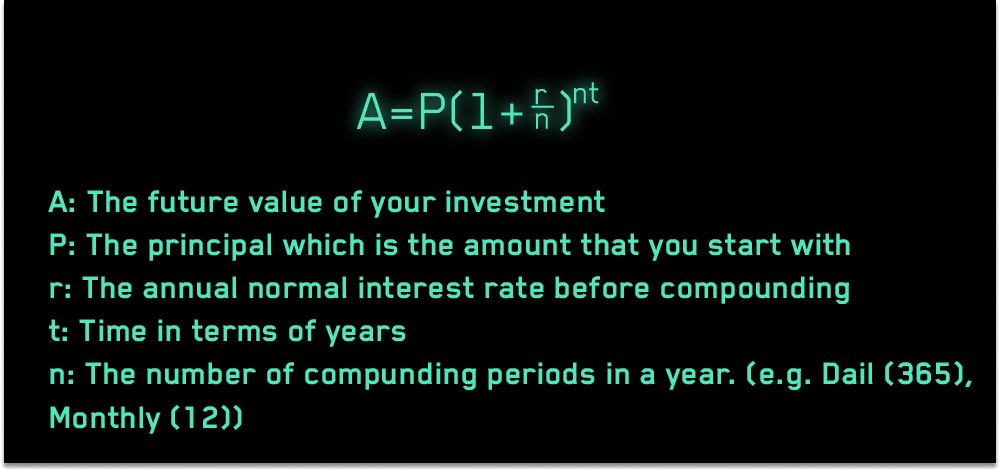

Compound Interest Formula

Compound interest can be calculated using the following formula:

To quote Albert Einstein, “Compound interest is the eighth wonder of the world. He who understands it, earns it; he who doesn’t, pays it.”

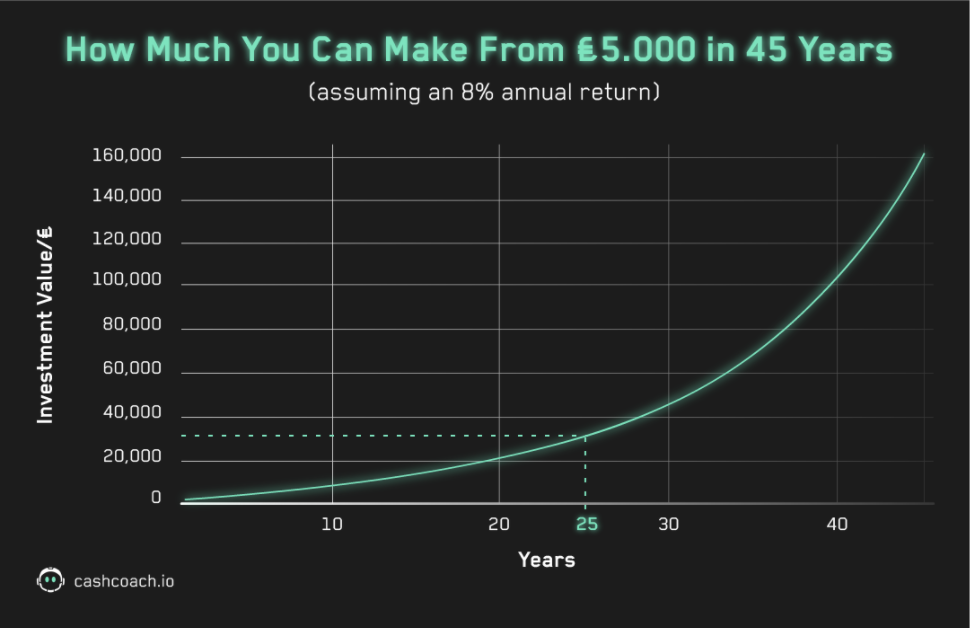

Compounded Growth of £5,000

Let’s take an example into consideration. Let’s say you are 20 years old and decide to make a one-time contribution to your retirement account. It earns an average of 8% return and compounds annually. If you never touch the money, that £5,000 will grow exponentially. By the time you retire at approximately the age of 65, your £5,000 would grow to just under £160,000. This can be seen in the chart below:

However, if you wait until the age of 40 to make your single investment, that investment would only be able to grow to less than £40,000. This point is marked on the graph above. Remember, time is the secret ingredient to the power of compounding interest.

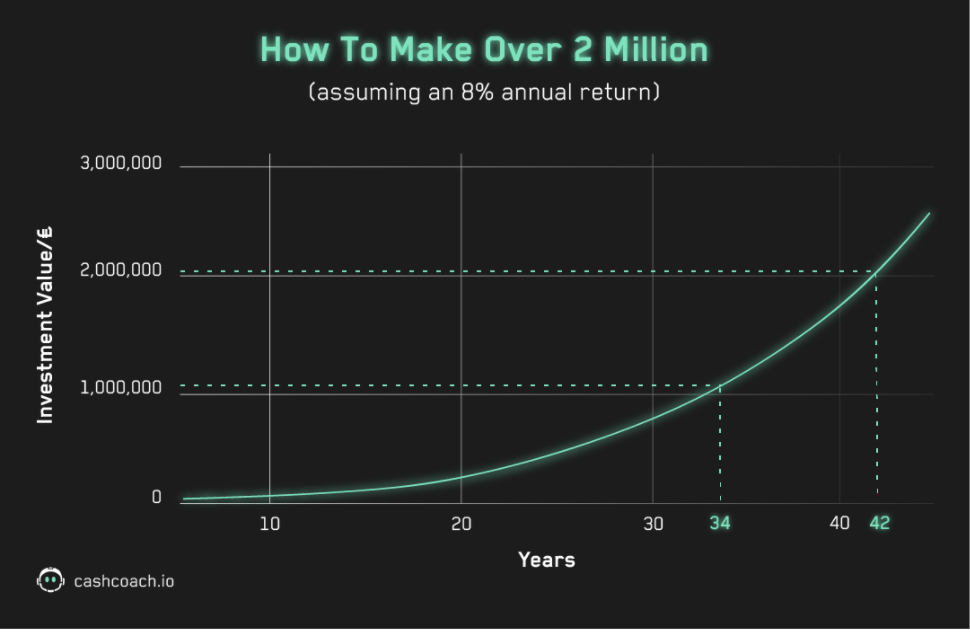

Growth of £5,000 with a twist - monthly contributions

If you think allowing £5,000 to grow through regular investing is great, imagine what this could become if you make saving a habit and contribute to your investment fund monthly! Following the last example of being 20 and making a one-time contribution of £5,000, if you follow this up with a monthly contribution of £500, you would be able to grow your investment to nearly 2.6 million pounds by the age of 65.

You would have 14 times more than the amount contributed.

It’s that simple to become a millionaire

And this is exactly how most millionaires are made. Most millionaires in the western world are not born rich, they become millionaires around the retirement age by using the force of compounded returns.

It is simple, but mastering the right habits is not easy, especially in a consumerist society that expects you to spend every single day. The good news is that we have created a great solution for all those who are serious about improving their financial habits: Nova.

It’s free, will help you set the right wealth creation goals, draw your objective line and motivate

you to stay on track. Try it now!