Easy Ways to Increase your Net Worth in 2021

What is Net Worth?

Net worth is the value of everything you own (your assets) minus your liabilities (your debt). For example, calculating your assets from the cash in your bank account to real estate you own and subtract your debt that may include a mortgage, credit card bills or student loans.

Your net worth can be a measure of your financial health.

1. Increase your Income every year

It’s tiresome to hear everyone go on about earning more money annually. We often hear we need to do it, but not how to do it. I’m about to tell you how to go about doing so. You should develop technical skills that are in high demand. For example, Artificial Intelligence (AI) and Machine Learning have become key buzzwords in 2020. According to a Linkedin 2020 Emerging Jobs (US) Report, hiring growth for an AI specialist has grown by 74% annually in the last four years. Skills like Python or Java are skills you may want to consider picking up to enhance your skills and sharpen your chances of success. Here’s a link to a Python crash course to get you started, and it only costs £12.99!

Besides technical skills, you should work on developing your soft skills. This includes your time management, social skills, communication skills and more. Unfortunately, most people do not see the wood for the trees. They are focused on instant gratification rather than delayed gratification. Look for the right experience now that will make you more valuable in the future rather than the one that earns the most right now. Investing in your skills will yield higher returns than instant cash right now. Honestly, invest in anything that will make you more competent. This includes the skills above as well as education, your mental and physical health.

2. Save Money and Reduce Spending

Saving money stems from adopting good financial habits and eradicating any form of toxic debt. Shelf your credit cards, cancel unnecessary subscriptions and follow some of these guides to get you started on your journey of financial freedom:

- Tips & Tricks to Living Frugally

- Clever Saving Tips

- Meals For £5 a Day

- Debt- Free Christmas 2020

- Upcycling Benefits Your Wallet

Stop Spending Money ImpulsivelyI

I know you enjoy browsing Black Friday Deals on Amazon, but do you really need a 4th Gen Echo Dot for 50% the original cost when you already blew £50 in the past on the 3rd Gen edition? No.

Golden Rule: If you can live without it, you don’t need it.

Impulse shopping is a huge contributor to reduced net-worths. Slashed prices and bundle promotions are merely sales tactics to get consumers to buy more or encourage them to spend money. Do you really need that £50 leather jacket? Do you really need to grab every deal at Sainsbury’s? Just because four pints of milk on sale costs £1 and 2 pints are priced regularly at 0.60p, doesn’t mean you should buy four pints. You are less likely to use the extra pints, and frankly speaking, that’s more than just money waste - you would be wasting food too. Remember, money wasted is money that could have been used to increase your net worth. Stick to what you need, not what you see.

Reduce Your Coffee Spending Habits

Statistics by the British Coffee Association shows cafe culture has continued to boom, stating 80% of people who visit coffee shops do so weekly, whilst 16% do so on a daily basis. People do not realise, small purchases add up. The truth hurts.

The average Flat White Tall at Starbucks in the US costs $3.75. If you get a coffee five days a week, this adds up to $18.75. In a month, the amount spent on just tall lattes adds up to approximately US$ 75. In a year, that would add up to approximately $900. The federally mandated minimum wage in the US is $ 7.25 and the average American works 8.8 hours per day. A Flat White costs over 50% of an hour’s worth of work.

A bottle of ‘NESCAFE CLASICO Dark Roast Instant Coffee 7 oz. Jar’ costs $5.22 and makes up to 100 cups according to Nescafe. If the average person purchases 240 cups of Flat Whites in a year, 3 bottles of Nescafe Clasico would last the year. Not to mention, 3 bottles of Nescafe Clasico costs less than a week’s worth of Flat Whites. A gallon of milk costs approximately $3.00. If 9 ounces is used to make a Flat White, milk used would cost approximately 21 cents per cup. A gallon would last you approximately 14 cups. Imagine the mega savings! Be the spice in your net-worth, not the spice in your Starbucks latte.

Upcycling is the new trend for increasing net-worth

Reusing is a great way to not only keep the environment in mind but a fantastic way to save money and increase net-worth. No, I’m not talking about buying yourself a tumbler to fill every day or a fashionable tote for the grocery store. Those things cost money!

I’m talking about the old squeeze bottle that comes with your store-bought hair dye. What do you do with it after? You could throw it away or you could use it to dispense dishwashing liquid if you shop in bulk. Most people throw away such containers when in reality they can be very helpful around the house. Take out containers from the Chinese restaurant down the road can be used for meal prepping. This is upcycling - taking something old, and making it useful again. This not only helps save the planet, it helps increase your net-worth. The more you upcycle, the less you spend, the higher your net-worth. Need I say more? Get started today!

Stop Living For Society

We live in a time where people are pressured to buy things they don’t need, with money they don’t have, for people they don’t like. It is vital to recognise the importance of withdrawing from consumer culture. It’s not about what people think of you that matters, it is what matters to you - increasing net-worth. Be prepared to say no to the pressures of buying the latest iPhone or owning a Birkin in your lifetime. It takes time, but it pays off (pun intended) over time.

Reject societal expectations. At the end of the day, you will have the last laugh and a net-worth that will give you a lifetime of financial security and most importantly, mental and emotional satisfaction.

3. Reduce Liabilities & Eliminate Debt

Liabilities’ refers to the amount of debt you owe. Common sources of debt include credit card debt, mortgages and consumer loans. In order to increase net-worth, you need to eliminate as much toxic debt as possible, especially if it costs more than what the stock market returns. For instance, consider refinancing your high-interest loans in order to pay off your debt quicker. By refinancing at a lower rate, you are essentially paying more towards the principal (amount owed before interest) and allowing yourself to gradually reduce your debt.

Nobody wants to pay more than they should. Remember, the money you owe is potential money that could be used to increase your net worth.

Eradicate Credit Card Debt

If you are not in debt, don’t fall into it. Credit card debt has spiralled over the years, this $1000 bn toxic debt is preventing many from increasing their wealth. Credit cards make many people believe they can afford things when in reality it is but an illusion. Monthly credit card payments spike and before you know it, you are suffocating in debt. Just because you think you can afford something, doesn’t necessarily mean you can afford it. If you need to borrow money in order to afford something, is it absolutely necessary? Say goodbye to Klarna! The name of the game- zero debt.

Once you have repaid all your toxic costing more than 8% interest rate, then move on to step 4.

- Learn How to Invest More Every Year

Unlike what most people believe, you do not need to know anything about the financial markets to make money through investing.

Secret: Invest in exchange traded funds (ETF) and become a millionaire.

ETF? An ETF is essentially an investment fund that trades on an exchange, like a stock. It basically replicates the performance of a stock market like NASDAQ, FTSE 100 or anything else. Investing in ETFs is simple, diversified, and beats 99% of the investment strategies carried out by humans.

ETFs trade similarly to stocks, however they greatly resemble mutual and index funds. Let’s look at an example of how an ETF will increase your net-worth in the long-run.

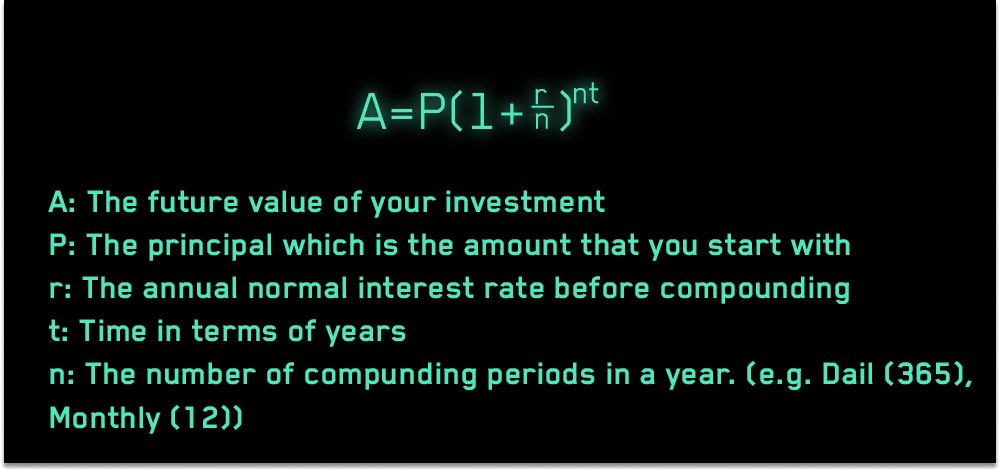

Your return on investment is based on compounding interest. It can be calculated using the following formula:

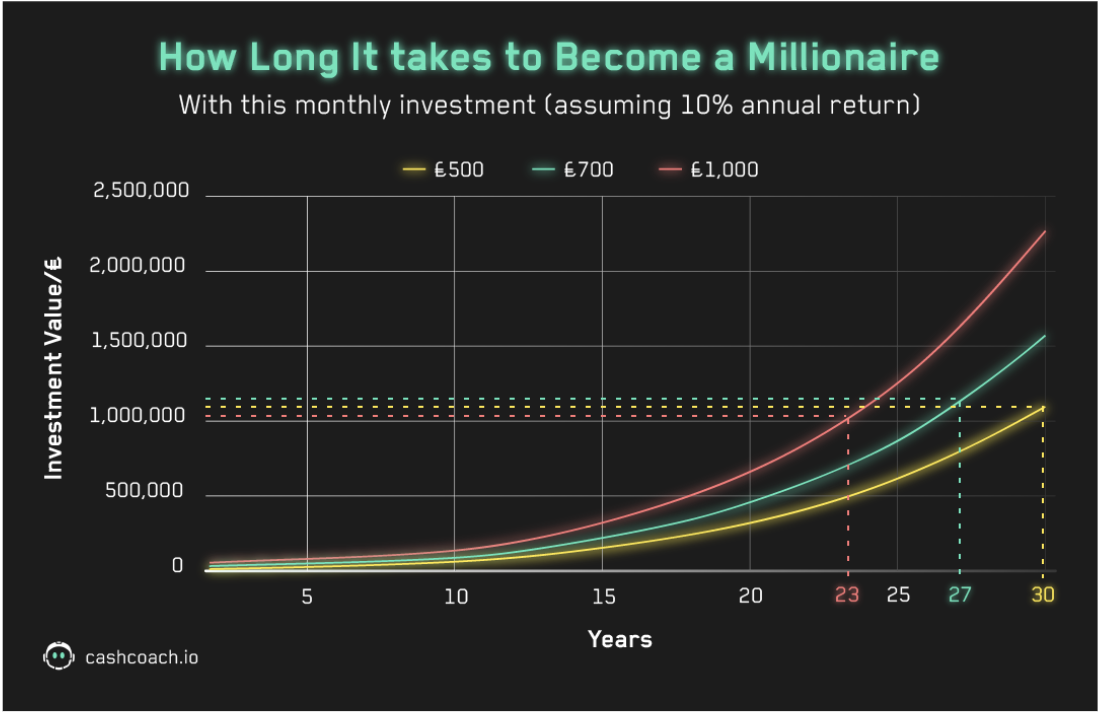

To quote Albert Einstein, “Compound interest is the eighth wonder of the world. He who understands it, earns it; he who doesn’t, pays it.” Since 1962, the S&P 500 has averaged a yearly return of 10% since 1962. If you invest £500, £700 or £1000 monthly into an ETF that mirrors the S&P 500 you will have:

The graph above shows how each amount grows exponentially. Assuming a 10% annual return, if you invest £500 monthly, you will make over a million pounds in 30 years. If you invest £700, you will make over a million in 27 years and if you invest £1000, you will make over a million in 23 years.

As you can see, the recipe to increase your net worth and eventually become a millionaire is quite simple. It’s only a matter of good habits.

The hard part is to develop and keep up with good habits because the temptation to spend is always more appealing in the short term. That’s why we created Nova to be your AI buddy; to give you encouragement constantly, and a kick in the butt when needed.

Try it, it’s free!