Why Saving Money Won’t Make You Rich

It is true that you need to spend less than you earn to accumulate savings. But saving money is not enough, you also need to put your money to work in order to build wealth. Saving money does not protect you from market conditions such as inflation and economic downturns. In essence, saving money creates opportunity, but investing is the way to capitalise on the chance to create more wealth.

The value of money decreases over time. This means $1 today won’t buy you the same amount of goods and services as it would in a decade. Let’s say the inflation rate averages 2.5% and you have a total of $1000 saved. This means the $1000 you saved today will be reduced to a value of approximately $690 in 15 years. Whilst a good or service that costs $1000 will cost you approx. $1448 in 15 years. Do you see the difference?

In order to beat inflation and maintain your current standard of living, you would need to make your money grow at a rate that is equal, if not higher than the current inflation rate in order to make a decent amount. And the only way to do this is to put your money to work by investing.

Unlike what most people believe, you do not need to know anything about the financial markets to make money through investing.

Secret: Invest in exchange-traded funds (ETF) and become a millionaire.

ETF? An ETF is essentially an investment fund that trades on an exchange, like a stock. It basically replicates the performance of a stock market like NASDAQ, FTSE 100 or anything else. Investing in ETFs is simple, diversified, and beats 99% of the investment strategies carried out by humans.

ETFs trade similarly to stocks, however they greatly resemble mutual and index funds. Let’s look at an example of how an ETF will increase your net-worth in the long-run.

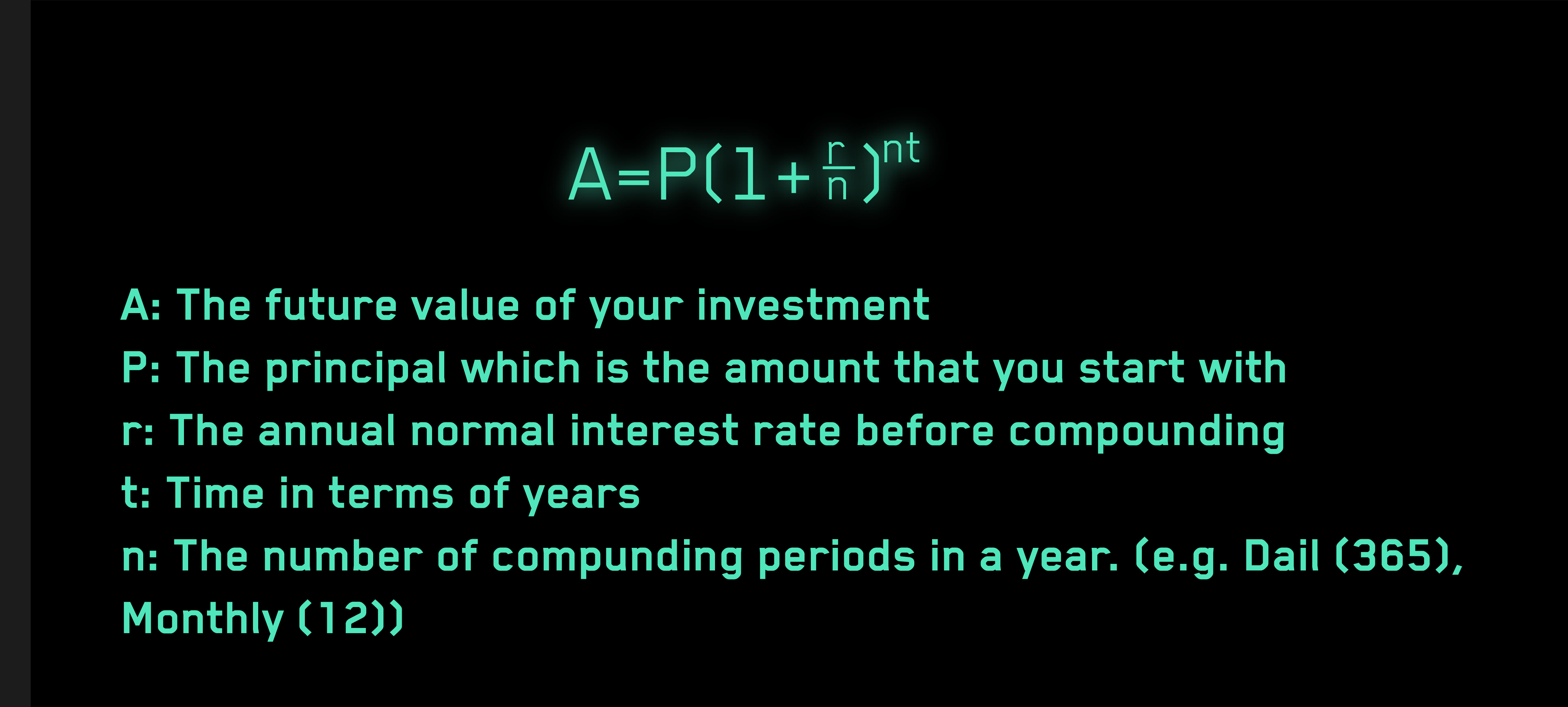

Your return on investment is based on compounding interest. It can be calculated using the following formula:

To quote Albert Einstein, “Compound interest is the eighth wonder of the world. He who understands it, earns it; he who doesn’t, pays it.”

Since 1962, the S&P 500 has averaged a yearly return of 10% since 1962. Assuming a 10% annual return, if you invest $500, $700 or $1000 monthly into an ETF that mirrors the S&P 500 you will make over a million dollars in:

- $500 - 30 years

- $700 - 27 years

- $1000 - 23 years

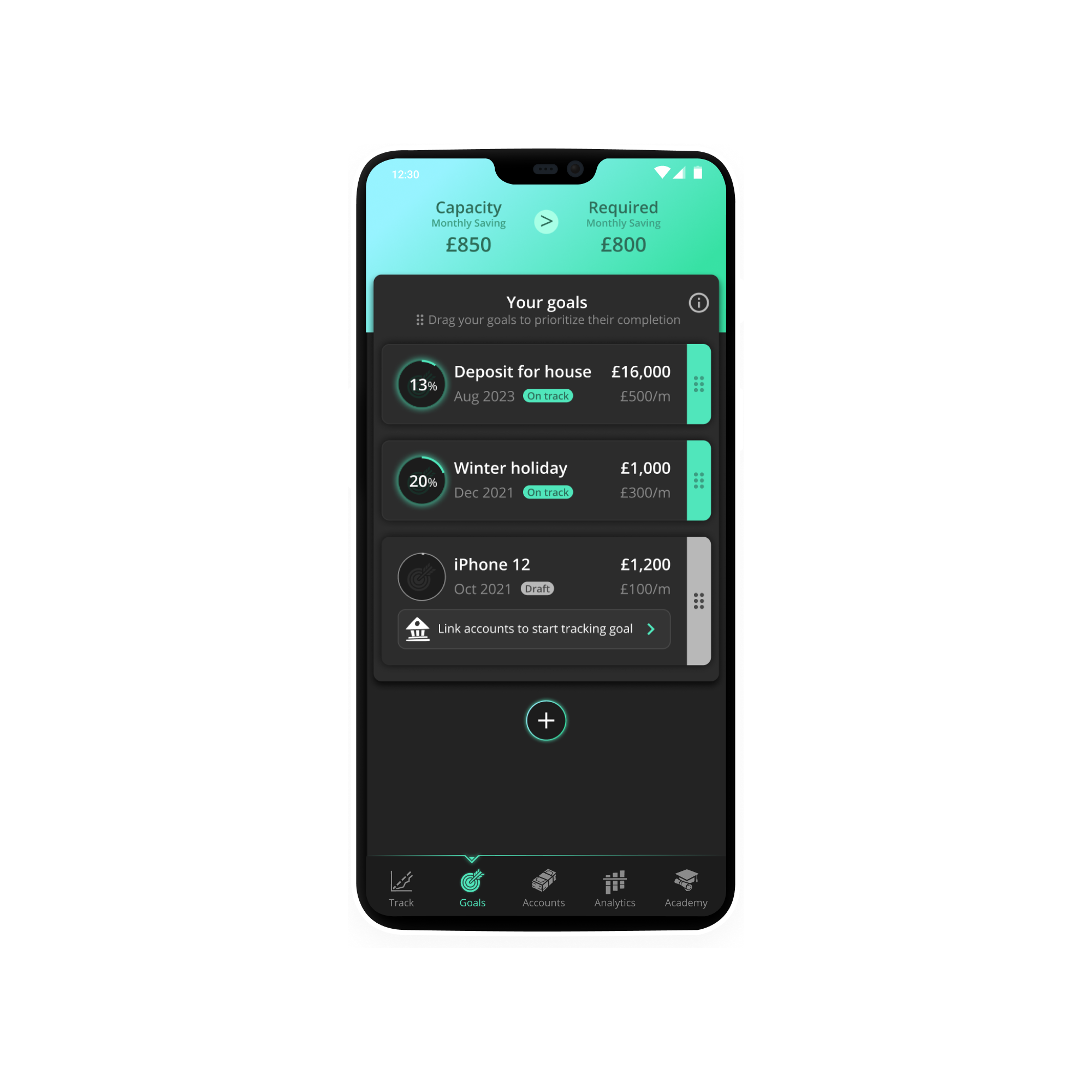

And with Nova, you can start monitoring your investments as well as your other financial goals.

Nova will put together a visual timeline to show you how you can achieve your goals. Nova provides real-time feedback on your spending patterns to improve your financial habits. Can’t save as much for the month? No worries! Nova will suggest adjusting your date of completion if you fail to reach your required saving for the month. The app allows you to prioritise your goals to see which order of completion you would like them to be in.

Whatever the goal, Nova’s got you covered.

The recipe is quite simple - get started today by downloading Nova for free now.