Remortgage: How Much Does It Cost to Remortgage?

With the repercussions of Covid-19, you may be looking to refinance your mortgage. Instead of focusing on just the potential of saving hundreds monthly, it is vital to fully understand how much it costs to refinance a mortgage. Here is an outline of the process to help you make an informed decision on refinancing.

Remortgaging fees

Simply put, it is replacing your existing mortgage with a new one in order to pay off the first one. There are several types of mortgage financing loans. Each type requires different considerations. You will need to work this out with your mortgage lender to figure out if refinancing will be worth it in your case.

The cost of your fee can vary based on the location, type and size of your property. Depending on your situation, your upfront fees can cost between $5,000 and $10,000. Besides that, you will need to factor in your credit score and other aspects of your personal finance profile. Remember, refinancing fees also vary between lenders as well as states.

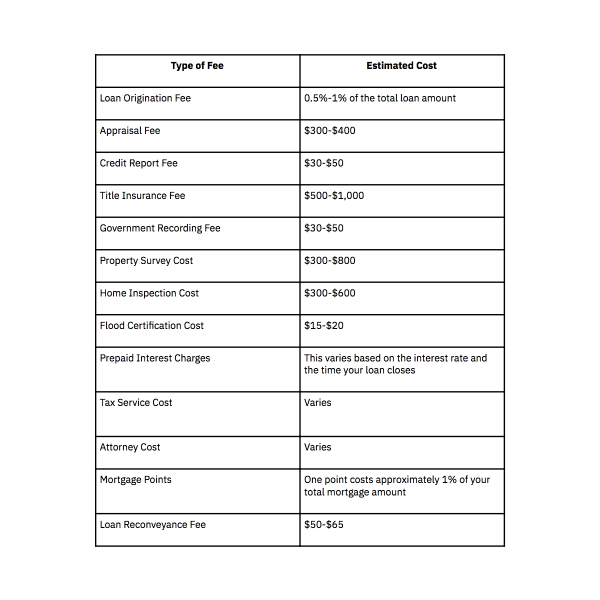

Here’s a list of what the refinancing closing cost can be:

By carrying out a cost-benefit analysis with your lender, you will be able to determine if the burden of refinancing is feasible. To best estimate refinancing fees on your mortgage, work with your lender to determine the costs in your specific situation.

Things to consider when refinancing:

Ask Yourself

1. Will the investment pay for itself?

You need to ask yourself how long will it take to earn back the cost of refinancing your home. You need to consider your ability to break even in a timely fashion. It makes more sense to consider refinancing if you plan on staying in your property for the long-haul and break even in the next few years rather than if you plan on moving out in a year or two.

2. How can I lower my refinancing costs?

You can lower your costs by improving your credit score and debt-to-income ratio. If you have a good credit score to begin with, you are in a much stronger position for negotiation in order to get the best possible rate offered.

If your property has been appraised in the last year and prices have not changed significantly, your lender may be able to waive a new appraisal. Ask if you can waive off the appraisal fee, this can save you a lot of money.

Be sure to do a comparison to find discounted third-party fees.

3. Will refinancing affect my credit score?

There is no doubt that refinancing a mortgage may have an impact on your credit score. This however is not permanent. If refinancing works in your favour, you should not be concerned about it hurting your credit-score in the long-run. It may not be the ideal situation, but it is extremely common and relatively easy for your credit score to bounce back.

First, consolidate your credit inquiries in order to reduce suspicion. You can lower the risk of impacting your credit score by working with your lender to avoid having them all run your credit.

4. Is my loan seasoned?

Your loan is seasoned if it has been out for over a year and you, the borrower has a reliable payment history. If you are five to ten years into paying off a 25-year mortgage, refinancing may not benefit you.

If you are losing your potential savings to additional interest costs, you are likely to lose more by refinancing. In other words, refinancing could be a good option for you if you can ensure you will not be losing money to interest fees.

If you are looking at when to remortgage, you can check out this guide here.

Final Thoughts

In the long-run, home refinancing can be a smart move. Refinancing a mortgage allows you to benefit from more cash in your pocket due to lower monthly payments.

You need to be strategic when it comes to where your additional funds go. Are you looking to become debt-free? Maybe you are looking to increase your net worth. Refinancing is a fantastic time to start budgeting and prioritizing your personal finance goals.

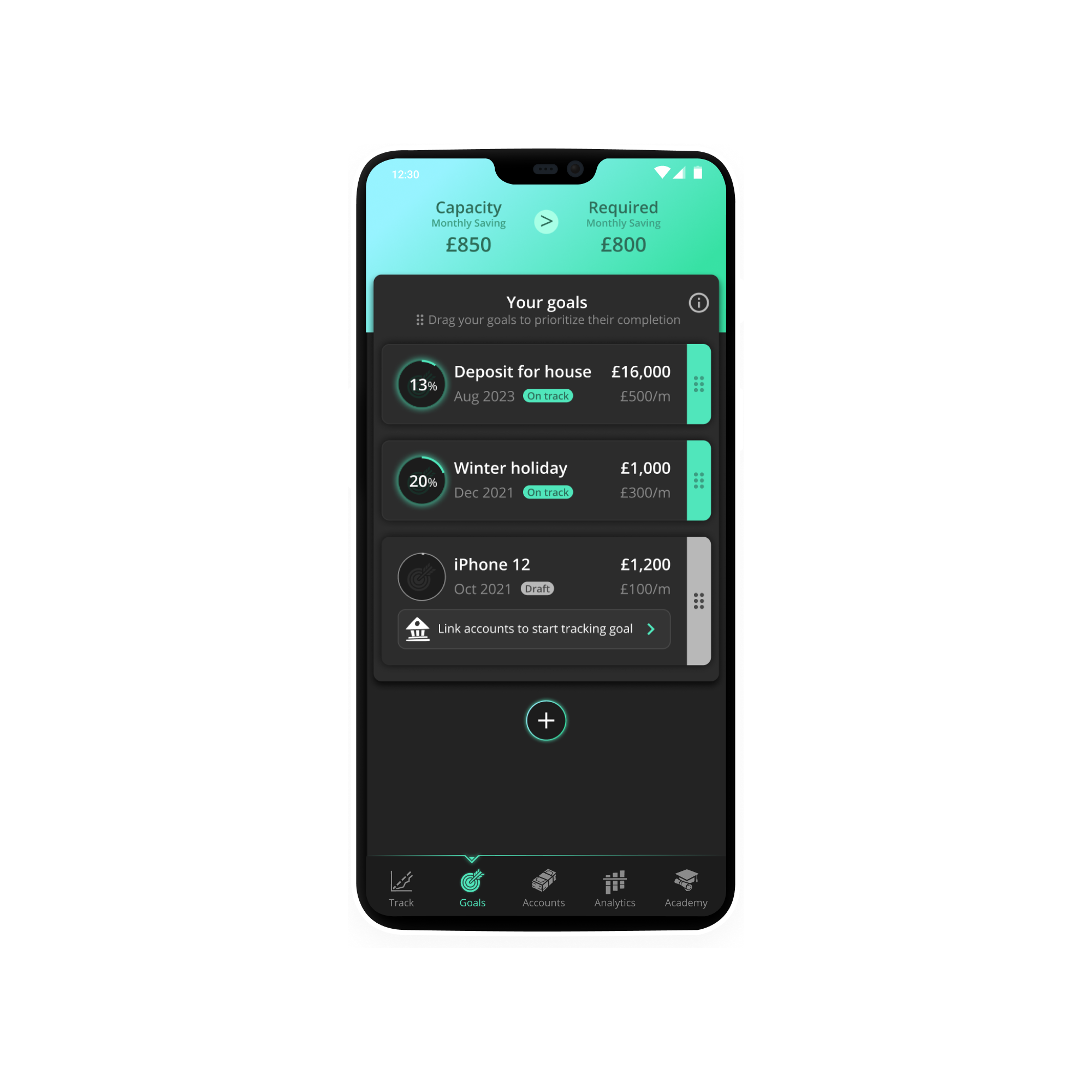

That’s why we created Nova, to help millennials who want to improve their financial habits. Nova is the personal finance app that makes saving more compelling than spending because the AI makes it easy to understand habits.

Buying your first home? Planning a trip? Getting out of debt? Nova will put together a visual timeline to show you how you can achieve your goals. Nova provides real-time feedback on your spending patterns to improve your financial habits. Can’t save as much for the month? No worries! Nova will suggest adjusting your date of completion if you fail to reach your required saving for the month. The app allows you to prioritise your goals to see which order of completion you would like them to be in.

Whatever the goal, Nova’s got you covered.

So what are you waiting for? Download Nova now to get started on your journey to financial freedom! Finance doesn’t have to suck, you are but a tap away from improving your finances.