Pay Yourself First: A Guide To Reverse Budgeting

What is paying yourself?

This is the idea that you are funding your own savings goals first before paying your bills or any other expenses. You should treat ‘paying yourself’ either to your retirement fund or emergency fund like a bill before paying all your other expenses.

The average person pays their bills on the first of each month, then saves the balance. Unfortunately, the issue with this strategy is that you do not put any emphasis on actually saving, hence making it much harder to meet your financial goals. It is said that a fifth of Britons have no pension savings at all.

What are the benefits and disadvantages of paying yourself first?

Here’s a list of the pros and cons of this methodology:

Pros

- You are guaranteed to reach your financial goals.

- This method helps you adopt the right saving habits for your future self.

- You are less likely to make impulse purchases.

- You would have built an emergency fund.

- You will learn the power of automation.

Cons

- If you are in a lot of debt, this method may not be ideal for you.

- It requires a lot of discipline.

- You may feel discouraged if you feel stretched financially at the start.

How to Pay Yourself First?

Let’s say you earn a monthly salary of £2,000. You are advised to save a minimum of 20% of your monthly income. This would be £400 that needs to be saved. This means you would have a balance of £1,600 to pay your bills.

This means on the first of each month, you will credit £400 into your savings or retirement fund and the remaining £1,600 will be used to pay your bills and expenses.

If you understand this concept, we can move on to the next steps on how to pay yourself first.

1. Analyse your spending

You will need to evaluate your monthly spending habits. If you have no idea where your money is going each month, you will struggle with paying yourself first. Furthermore, by analysing your spending pattern, you will be able to identify where you may be overspending and can cut down on it. I personally didn’t realise how much I was spending on subscriptions and how much they had gone up since I first signed up, so I decided to start using this subscriptions tracker to get them in control.

A lot of people track their spending on an Excel Spreadsheet. For those who don’t particularly like spreadsheets, you can choose to download Nova, an AI money planner that will not only analyse your spending patterns but also keep track of your subscriptions and help you adopt the right spending habits in order to reach your financial goals.

2. Set your financial goals

It’s important to ask yourself what you are looking to save for. Is it a short-term goal such as purchasing a new macbook? Or are you looking to save for a more long-term goal such as a house mortgage?

Either way, you will need to write down your short-term and long-term goals, either in a spreadsheet or use a goal planner like Nova that can help you define the right goals. Remember, it’s important to also have an emergency fund - an emergency fund is essentially money you have set aside for unexpected events in life including personal ones as well as ones we have no control over i.e. financial crisis/global pandemic. Ideally, you should have saved up 3-6 months worth of monthly expenses. If you do not have this, it’s important for this to be one if not your primary savings goal. By building an emergency fund, you do not need to resort to the use of credit cards and falling into the toxic credit card debt trap.

3. Work out your reserve budget

The traditional way of budgeting doesn’t work: 75% of people fail to hit their budget. It’s hard to stay motivated to save a random amount without a clear purpose. That’s why Nova works in reverse: you set your goals, and then Nova works out your monthly budget. If you want to save more, just increase your goals.

The pros of reverse budgeting are:

- You’ll pay yourself first and hit your financial goals every month

- This allows you to spend what’s left rather than save what’s left

- You reduce the risk of impulse purchases

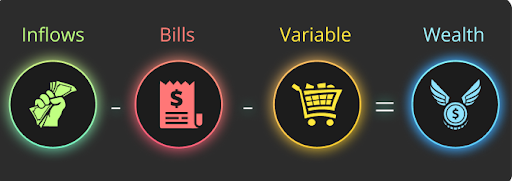

Nova calculates your budget based on your goals, using the Wealth Equation:

- Inflows: sum of the money you receive

- Bills: sum of all your fixed costs (rent, utilities…)

- Variable: sum of all your variable costs (anything not fixed)

- Wealth: money you gain. It can sit in your current account, savings account, investment account or be used to repay debt.

Nova budgets using calendar months (and not payday to payday). Here is why.

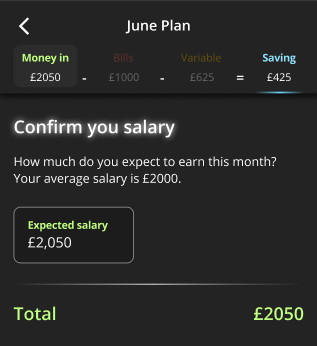

Step 1: Confirm your income

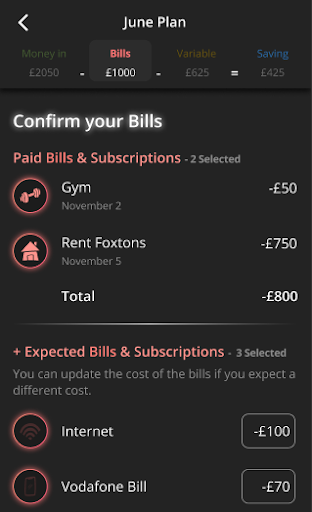

Step 2: Confirm your bills

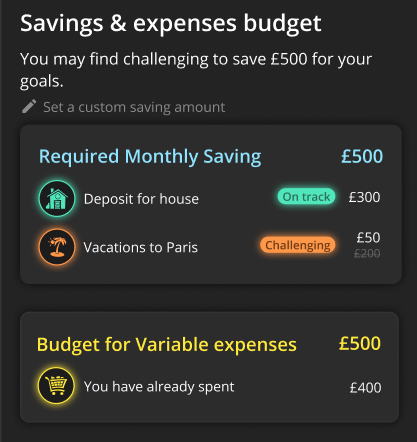

Step 3: Review your financial goals and budget

Nova calculates what you have left to spend on your Variable expenses to progress on your goals. If you have already spent too much this month, Nova will show you a warning message:

Nova can automate the whole process for you.

4. Automate your monthly savings and investments

Automation does not allow room for temptation. By automating your savings, you are ensuring that you stick to the monthly savings goal. How do you automate it? Simply set up an automatic monthly transfer - this way you are not tempted to save less nor forget to move money into your savings every month.

5. Track your progress continuously

It’s important to follow through with your plan. Remember, it’s not easy implementing a new regime in your life, it takes time to get used to. So don’t be too hard on yourself.

What if I don’t have enough money left to pay my bills?

If you find yourself in a position where you can’t seem to pay off your bills, you have two options: take a look at your spending to look for areas you can cut back on or you can look for ways to make extra income on the side. So yes, you can choose to cut back on meals out or take outs for example or you can consider earning a side income through maybe selling off items you don’t need. You could also make some extra income from the comfort of your own home by tutoring or doing some usability tests - take a look at this list of things you can do to make some extra income.

Final Thoughts

It’s important to recognise that paying yourself means you are prioritising your own savings over your expenses. This is the best way to ensure your short-term and long-term savings goals. Whilst it requires discipline and willpower, in the long run, you will find a way to make the plan work for you and you reach financial independence a lot quicker than you think!

With Nova, you’ll find it easy to set goals and adopt the right spending habits. Nova will put together a visual timeline to show you how you can achieve your goals, and give you real-time feedback on your day-to-day spending. Remember, paying yourself first is a proven methodology that works! Try it out now right here.