New Year New Me 2021

The New Year is just around the corner and all of us are thrilled to be ending this year of uncertainty. A lot of us look at the new year as a clean slate, a fresh start, a new beginning. As the phrase goes, ‘new year, new me.’ People often take this as an opportunity to make resolutions to better themselves. But, how many of us actually follow through and stick by our new year resolutions? According to YouGov, about 25% of Britons made New Year resolutions in 2018, however a year on, only under a quarter (24%) managed to keep to all their resolutions.

Is the concept of resolutions the best way to keep yourself in-check for the New Year or is it but another fad to keep in trend with society? It’s nice to say, but it’s hardly easy to keep at. Either way, here is an alternative to resolutions - goals. Ask yourself what you would like to prioritise in 2021, and stick to those goals. Here’s a list to get you pondering, and most importantly, they can be achieved whilst keeping your spending habits under control.

Physical Health

Are you looking to prioritise your physical health in 2021? If so, you could get started by doing workouts right from the comfort of your living room. Covid-19 has opened doors to physical health through the internet. Youtube workouts became a massive HIIT (pun intended) and the saving grace to many fitness enthusiasts stuck at home. Channels such as Yoga with Adriene, Hasfit and Blogilates are some to check out. There is plenty more, and it is absolutely FREE.

If you are looking to be a little more social, ClassPass, will give you the chance to book in-studio and at-home fitness classes as well as gym access or book services at top salons and spas nearby. This pass can be purchased from as low as £15!

ClassPass has ensured prioritising safety during Covid-19. Their fitness and wellness partners are implementing new guidelines to protect the health and safety of their users. Safety and cleanliness info of the booked places can be found right on the app! What are you waiting for? This is a great chance to get started on your physical health!

Financial Education

Financial illiteracy is more prevalent than we know. A 2020 survey reported by Business Insider found that 9 in 10 consumers in the UK feel they are undereducated in terms of financial. 72% of consumers reported they do not invest in stocks and shares or investment funds, with nearly a fifth stating they do not know how to.

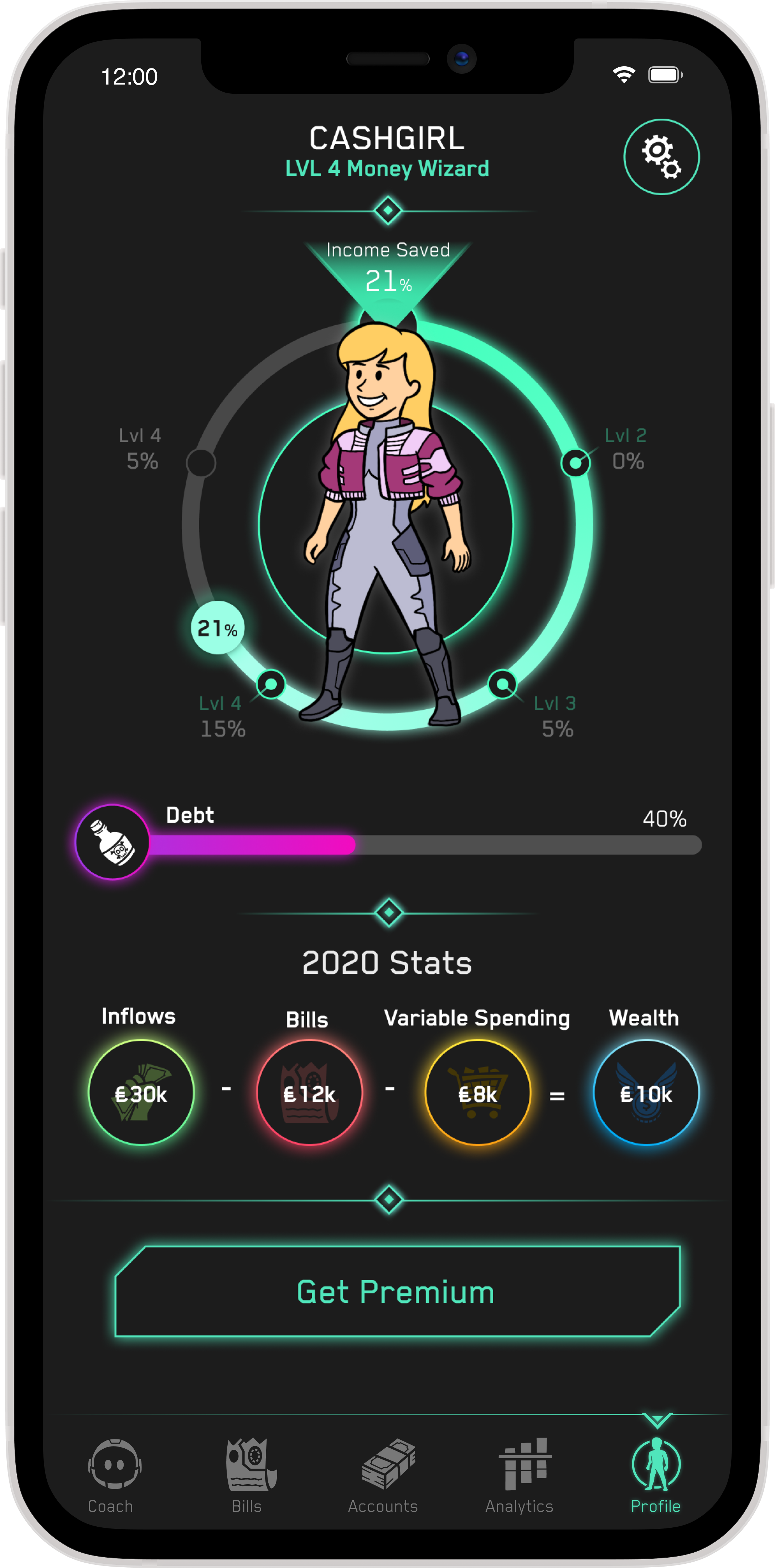

Are you looking to increase net-worth, keep on top of personal finance and improve financial literacy? Look no further! Nova is the UK’s first gamified saving app. It is catered to help millennials keep track of their finances in a fun way.

Your in-app avatar levels up as you improve your spending habits. Your interactive AI-coach will help you along the way and crunch the numbers for you whilst you build wealth and kill debt in real-life! It is simple and it works.

You can purchase a year’s subscription to the Premium Plan for only £35.99 The premium plan features unlimited transaction history, stats for geeks, all AI personalities, bill monitoring and priority support. The return on investment would be an increased net-worth, priceless financial education and most importantly, financial freedom at no extra cost! Most importantly, this is a goal you can keep in mind for a lifetime.

Eat Healthy For Less

It is a fact that the U.K. takeaway sector is a multibillion dollar industry. According to Statista, households spend an average of over £5 weekly on takeouts. With the rise of UberEats, Deliveroo and many more, there is no real need to cook or learn to cook to begin with. Adulting can be difficult and when food is but an app away, cooking may be intimidating to many. A lot of the time, people do not know how to repurpose ingredients and find meal planning very time consuming. However, you could save a huge amount of money from cooking your own meals. I have the perfect idea for your New Year resolution!

Sorted Club is a great meal pack initiative that is catered to help the average person learn to cook quick midweek gourmet meals for 2 or 4 pax. It is an app that comes with weekly meal packs to choose from - users are allowed to choose a pack a week, and you will receive both written and audible instructions to help you through the entire process. Best of all, you will receive a grocery list along with your meal pack that smartly combines ingredients in the recipes to save you money, and eliminate food wastage! Friend’s a vegetarian? Not to worry! They have plenty of vegetarian packs to choose from. It only costs £4.99 monthly or £49.99 annually.

This is a great initiative to increase productivity whilst saving money and reducing food waste! And best of all, this app will keep you in check with your weekly packs to choose from! New Year Goal: Check!

Mental Health

Last but definitely not least, mental health. If there’s one thing Covid-19 has taught us, it is not to neglect mental wellness. Just like our bodies, our minds need routine checkups every now and then. Therapy is absolutely healthy and it is okay to seek advice if you think you need it. With the new tier restrictions, if you live on your own or are eligible to have a support bubble, remember to utilise this avenue. Talk to your loved ones, talk to a friend, and even if need be, you can talk to a stranger. Sometimes getting things off our chest is the best remedy to feeling better. Here is a link to a list of mental health support organisations you can reach out to. These resources are free, it doesn’t need to cost money to get the right help.

New Year New Me has never been more realistic and affordable to achieve! If you know what you want to prioritise in the new year, you are a step closer to making your year a better one. Say Goodbye to 2020, Hello 2021!