Money facts: why most people are not saving money

In this blog post, following our mission to expand financial education and make you the best at smart spending; we present to you the facts on why people miscalculate how much they are really saving.

If by the end of the month you transfer £250 to your savings account, have you saved £250?

If you answered “Yes”, keep reading - this article is for you. Spoiler alert: the correct answer is NO.

Don’t worry, a LOT of other people have misconceptions about how much money they’re actually saving too. I want you to forget, for a moment, all of your concepts about saving and bear with me.

Let’s get started!

Money Fact: Moving money to a saving account is a zero-sum game

Simple Example

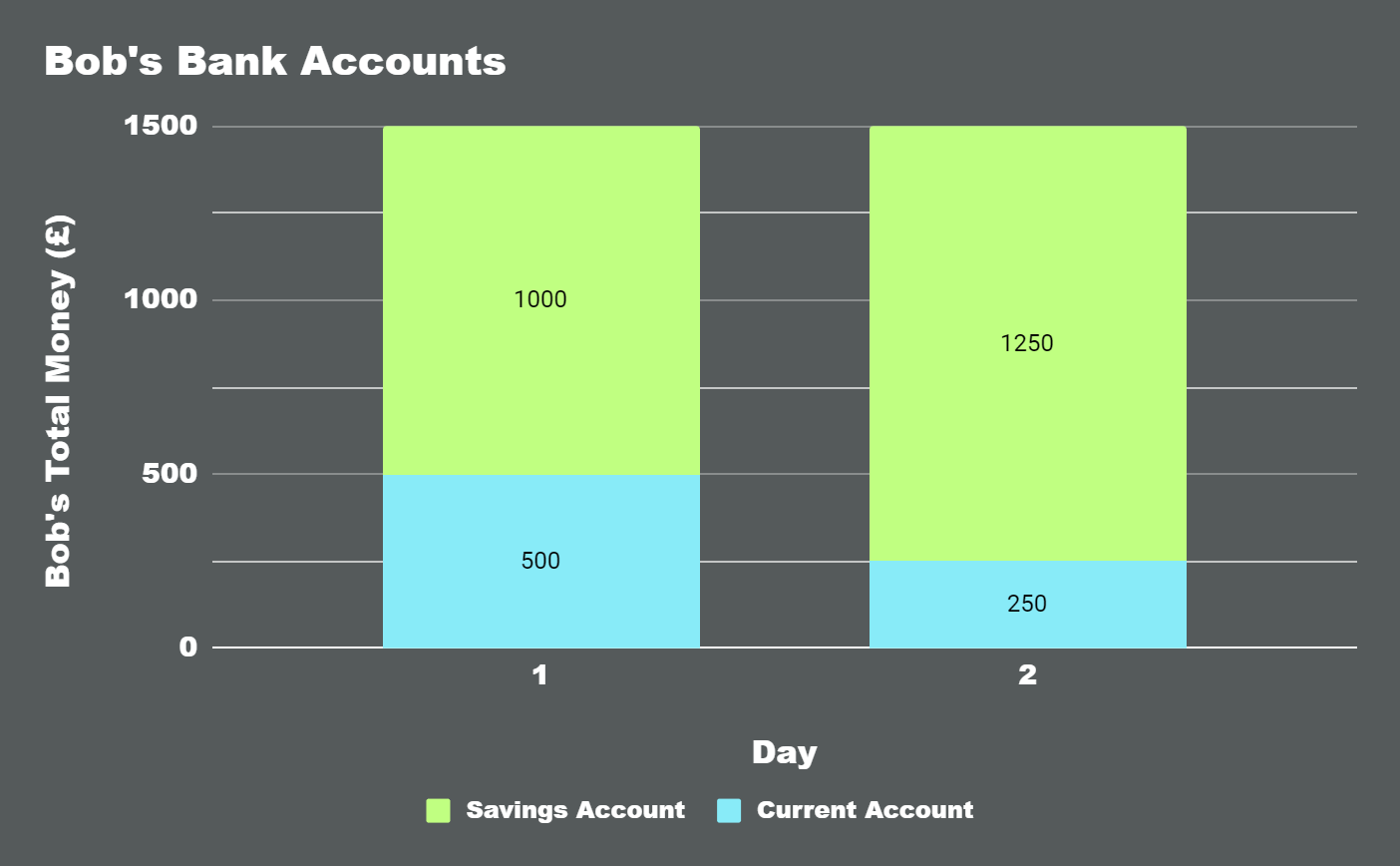

Let’s say Bob has £500 in his current account and £1,000 in his savings account for a total of £1,500. Now he transfers £250 from his current account to his savings account. Is he £250 richer? Obviously no, moving money across accounts is a zero-sum game.

You might say that Bob saved £250 that day, but his total net worth remains £1,500.

That was just a simple example so let’s look at a more realistic one involving spending with debit cards…

Realistic example:

Imagine Bob:

- starts the month with £400 in the bank

- earns £3,000

- spends £2,900

- transfers £300 to savings account

How much did Bob save? £300? No, that can’t be… 🤔

As you can see, the concept of “saving” can be misleading, so let’s think in terms of “wealth creation” instead.

Money fact: Most people don’t understand the Wealth Equation

Your wealth represents how much you are worth financially. It’s the sum of all your money, investments… your “assets”.

Every month is a cycle where you gain income, pay the bills and many other expenses. The difference between what you gain and spend is what companies call would Profit & Loss. Since you are not a company, we call it Wealth Created/Lost. If this figure is positive then you have created wealth, if this is negative then you are burning money (not a good idea). You see, it’s very simple!

For those like formulas, here is the wealth equation:

Wealth creation = Money in - Money out

This, therefore, means that transferring money from your current account to your savings account does not affect your wealth as you are simply just changing the location of the money you already have.

Applying the wealth equation

Starting with £400 in the bank, Bob had the following cash flows:

- Income: +3000

- Expenses: -2900

- Wealth created = 3000 - 2900 = £100

| Start of the month | End of the month | |

|---|---|---|

| Current account | £400 | £200 |

| Savings account | 0 | £300 |

| Total Wealth | £400 | £200 |

As you can see, although Bob moved £300 on a savings account, he only created £100 wealth.

Money facts: Nova can help you track your monthly wealth creation

By now it should be obvious that you should track your wealth creation rather than “saving”. However, you might argue that no budgeting/banking app tracks that for you, and you would be right. How come?

Well, the financial industry makes $200+bn profit on credit card debt, $40+bn on overdraft fees. They feed on the lack of financial education that keeps people in poverty.

I created Nova to help millennials build their wealth. The app uses Open Banking to aggregate your accounts, calculate your monthly Wealth Creation and track your progress.

Track the right thing and take control of your finance, Nova is free to download.