7 Ways to Start Saving Money Today

Here is the second part of the clever money-saving tips series. You can read our first blog post on money-saving tips and how to be more frugal here!

Leeching off Entertainment Subscriptions

Have I caught your attention? Before you pounce on me and give me your two cents, hear me out. We live in the age of globalisation, millennials are known as the generation of ‘No Nation.’ A study by Move hub shows that millennials have less purchasing power than their parents’ generation and many see long term investments such as owning property but a fantasy. With not much holding them back, millennials are more than ready to move abroad seeking a more affordable and better standard of living.

Now, ask yourself, how many people do you actually know abroad? For example, I live in a household of 3 different nations across two continents. Imagine having a Netflix subscription and sharing that out with someone who is approximately 7-8 hours behind in time. Not only does the subscription get fully utilised, having it at the price for one is a win-win for everyone. This is not illegal, this is not selfish, this is smart usage. This does not necessarily apply to everyone, but it is a great way to combat wasteful spending. Essentially, be smart with your subscriptions and how you use them.

Good coffee for you and your wallet:

Invest in making your own coffee. The average Flat White Tall at Starbucks in the US costs $3.75. If you get a coffee five days a week, this adds up to $18.75. In a month, the amount spent on just tall lattes adds up to approximately US$ 75. In a year, that would add up to approximately $900. The federally mandated minimum wage in the US is $ 7.25 and the average American works 8.8 hours per day. A Flat White costs over 50% of an hour’s worth of work.

A bottle of ‘NESCAFE CLASICO Dark Roast Instant Coffee 7 oz. Jar’ costs $5.22 and makes up to 100 cups according to Nescafe. If the average person purchases 240 cups of Flat Whites in a year, 3 bottles of Nescafe Clasico would last the year. Not to mention, 3 bottles of Nescafe Clasico costs less than a week’s worth of Flat Whites. A gallon of milk costs approximately $3.00. If 9 ounces is used to make a Flat White, milk used would cost approximately 21 cents per cup. A gallon would last you approximately 14 cups. Imagine the mega savings! Be the spice in your wallet, be the spice in your latte.

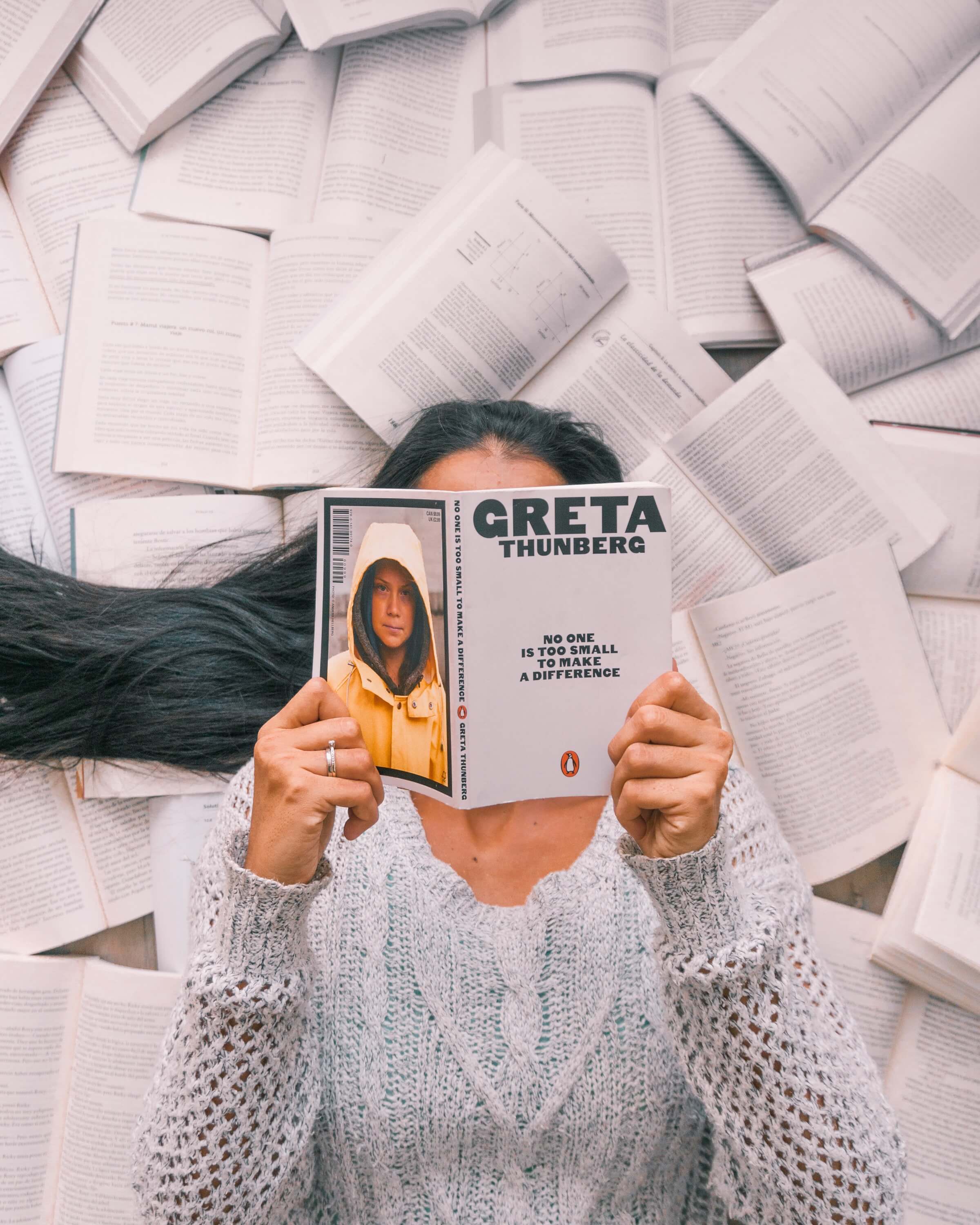

Reusable products are your friend. Keep Calm & Thunberg On

Let’s face it, recycling is but a myth. It doesn’t necessarily help the environment and it most definitely does not help our pockets. But that’s now why we’re here. Reusing is a great way to not only keep the environment in mind but a fantastic way to save money. No, I’m not talking about buying yourself a tumbler to fill everyday or a fashionable tote for the grocery store. Those things cost money!

I’m talking about the old squeeze bottle that comes with your store bought hair dye. What do you do with it after? You could throw it away or you could use it to dispense dishwashing liquid if you shop in bulk. Most people throw away such containers when in reality they can be very helpful around the house. Take out containers from the Chinese restaurant down the road can be used for meal prepping. The name of the game is to consume less and create more.

If you want to learn more about this, you should read our blog on upcycling ideas!

Exercise for less via Youtube

Covid has opened doors to health through the internet. If you’re not one for weight training, or need large equipment, say goodbye to wasting money on yoga classes, cute workout attire or deteriorating self-esteem. The average group yoga class costs about $20 or less per class. During lockdown, Youtube workouts became a massive HIIT (pun intended) and the saving grace to many fitness enthusiasts stuck at home. Channels such as Yoga with Adriene, Hasfit and Blogilates are some to check out. There is plenty more, and it is absolutely FREE.

Not to mention, this really helps with self-esteem and mental health. The pressures of looking good and being deemed unfit in a public setting can be intimidating to many. Free home workouts combat these feelings and truly shape a person to his/her best self. Mental health is just as important as physical health. Health doesn’t have to cost money, use your resources wisely.

Marie Kondo your Inbox

The exclusive sales and attractive coupons attached to marketing emails can be irresistible to many. These emails are designed to draw sales. If you are someone who is easily enticed by such gimmicks, click that unsubscribe button. Marie Kondo your life and remember only keep things that spark joy. Declutter your inbox, it will save you space, and most importantly, your pockets.

Delete your shopping apps

Say Goodbye to Amazon, Asos, and most importantly, Klarna! Online shopping is a big contributor to the debt trap. It makes people believe they can afford things when in reality it is but an illusion. Monthly credit card payments spike and before you know it, you are drowned in debt. Just because you think you can afford, doesn’t necessarily mean you can afford it.

Nobody wants to pay more than they should. Don’t allow yourself to fall into the debt trap. If you need to borrow money in order to afford something, is it absolutely necessary? The name of the game- zero debt.

Don’t fall for price skimming

Slashed prices and bundle promotions are merely a sales tactic to get consumers to buy more or encourage them to spend money. Do you really need that £50 leather jacket? Do you really need to grab every deal at Sainsbury’s? Just because four pints of milk on sale costs £1 and 2 pints is priced regularly at 0.60p, doesn’t mean you should buy four pints. You are less likely to use the extra pints, and frankly speaking, that’s more than just money waste - you would be wasting food too. Stick to what you need, not what you see.

If you want to learn more read our recent psychological pricing blog!

Don’t forget that Nova is here to help you become the best at taking control of your finances! Your personal AI coach is here to motivate you and help you achieve your financial goals. Good luck 😎