How to Start an Emergency Fund

What is an Emergency Fund?

Simply put, it’s money you have set aside for unexpected events in life including personal ones as well as ones we have no control over i.e. financial crisis/global pandemic.

How much should an emergency fund be?

Ideally, 3-6 months worth of monthly expenses. To get an estimate of this, add up how much you spend monthly on basic and crucial expenses including:

- Rent

- Mortgage

- Utilities

- Groceries

- Petrol

- Insurance

- Healthcare

Once you know this amount, you can multiply it by three to six months to figure out your emergency fund target amount.

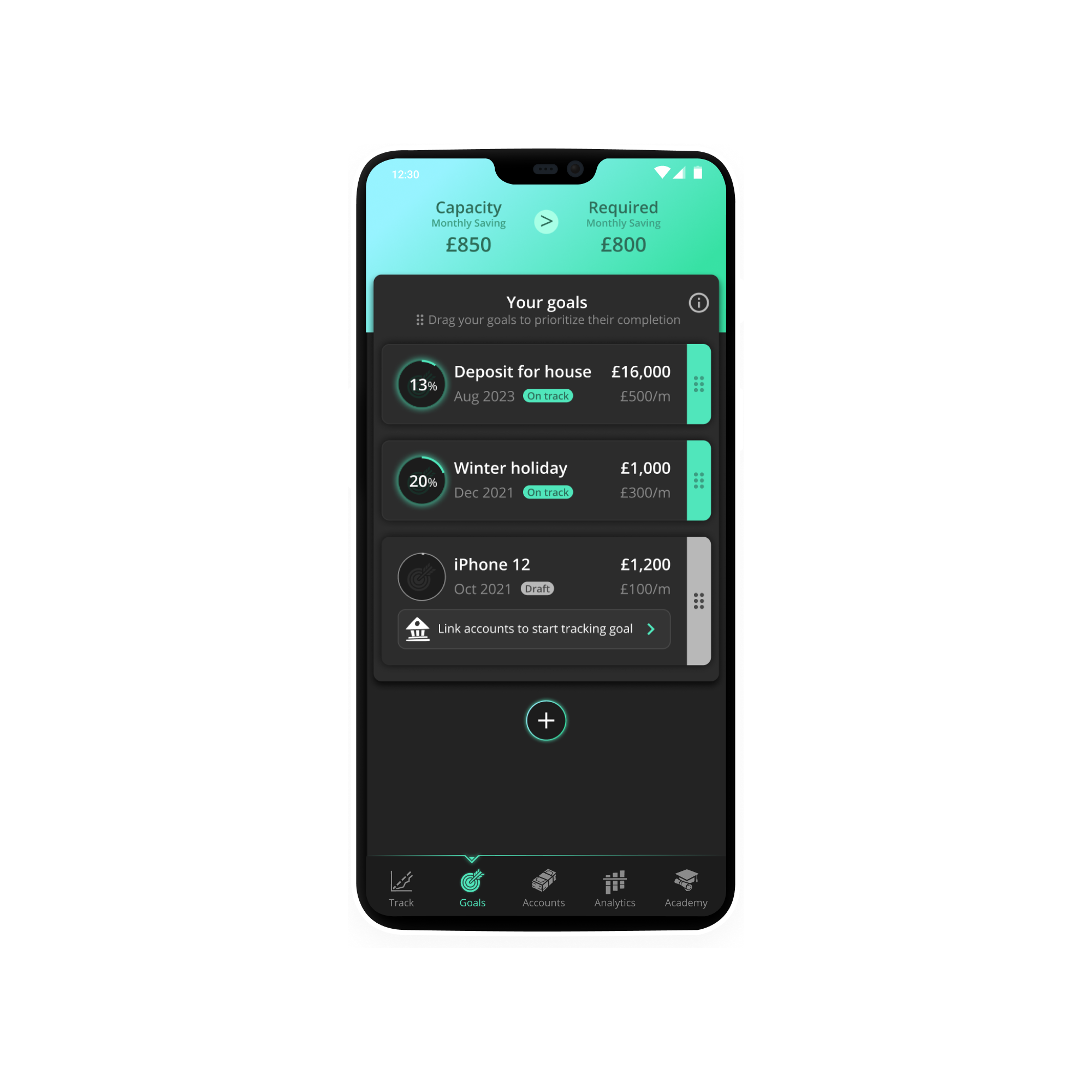

In order to build your emergency fund, you will need to plan how much you will set aside for the fund. You do not need to forgo your financial goals just to build your emergency fund, you can do it simultaneously with Nova.

Nova is the personal finance app that makes saving more compelling than spending because the AI makes it easy to understand habits.

Building your emergency fund and paying for your mortgage? Nova will put together a visual timeline to show you how you can achieve your goals. Nova provides real-time feedback on your spending patterns to improve your financial habits. Can’t save as much for the month? No worries! Nova will suggest adjusting your date of completion if you fail to reach your required saving for the month. The app allows you to prioritise your goals to see which order of completion you would like them to be in.

Whatever the goal, Nova’s got you covered.

Where should you keep your emergency fund?

Whilst your emergency fund should be readily available, there is no harm in trying to make the most out of your emergency fund rather than having it lying around earning close to no interest, if not at all. Here are a couple of options to give you an idea of what to look out for:

-

Interest Bearing Current Accounts

Many banks offer decent interest rates on small amounts of deposits i.e. £1.5 to £5k.

-

Cash ISA - Instant Access

This works similarly to a bank account. A Cash ISA is likely to pay you more interest than a bank account would on your pot of money that is sitting and waiting for you. Instant Access Cash ISAs are flexible and allow you to make money in and out whenever you want. It is likely to come with a better interest rate than a bank account, however, it will not be as good as Fixed Rate Cash ISA.

Cash ISAs can be opened with as little as £1. However, it is important to take note that you can only have one active cash ISA annually. This type of ISA is protected by the Financial Services Compensation Scheme (FSCS.)

I hope you found this article helpful. Don’t forget, building an emergency fund is easier than you think once you set is as a goal, a priority. Remember, you can do just that with Nova. Download the app now, it’s free!