How to Cancel Council Tax When Moving House

What is Council Tax?

Council tax is the tax paid to your local authority if you are an adult. For example, if you live in Richmond, London you would pay your council tax to Richmond Council. Unsure of your local council? You can use this link to find it. A full bill is based on a minimum of two adults living in a home. Spouses and partners who live together are jointly responsible for paying the council tax bill.

How to work out Council Tax:

In order to work-out your Council Tax you would need to know the following:

- The valuation band of your home in England & Wales. Bands are different in Scotland.

- How much your local council charges for the band.

To check out your Council Tax band in England or Wales, use this link.

Council Tax in Scotland, check out this link.

Now, how to cancel council tax if you are moving. Remember, every council is different.

What Happens with Council Tax When Moving House? Who should be informed when you move?

Whether you are moving to a new home or renting and moving to new accommodation or your own home, you need to inform your local authority. Be sure to start this process a month prior to moving.

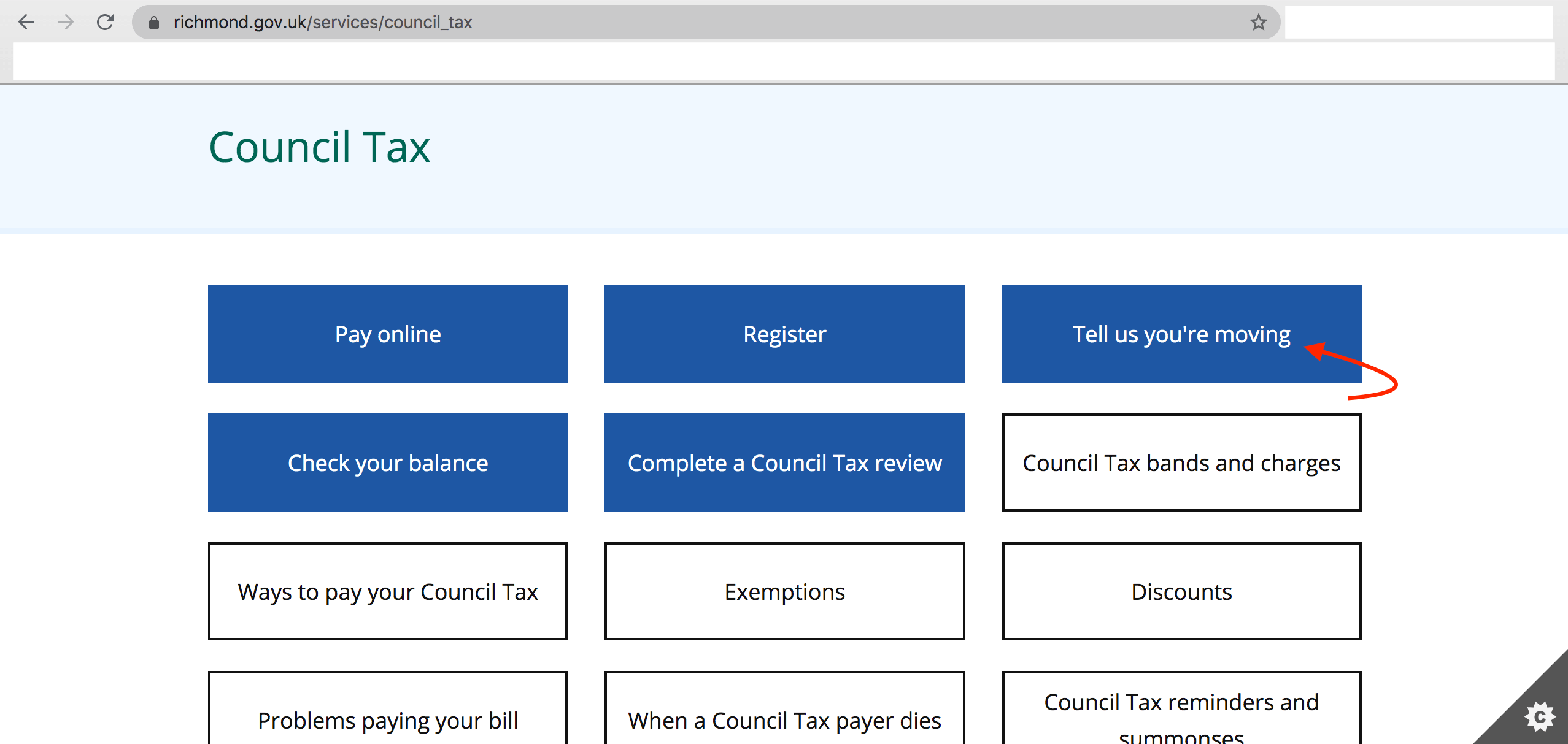

On your local authority’s website, you would be able to change your address. There should be a Council Tax section followed by a subsection with regards to “address changes” on the website. For example, the Richmond Council website looks like the following:

Last Bill

You should receive your last bill close to your move out date. Be sure to pay this before moving to your new home.

Moving from one administrative area to another

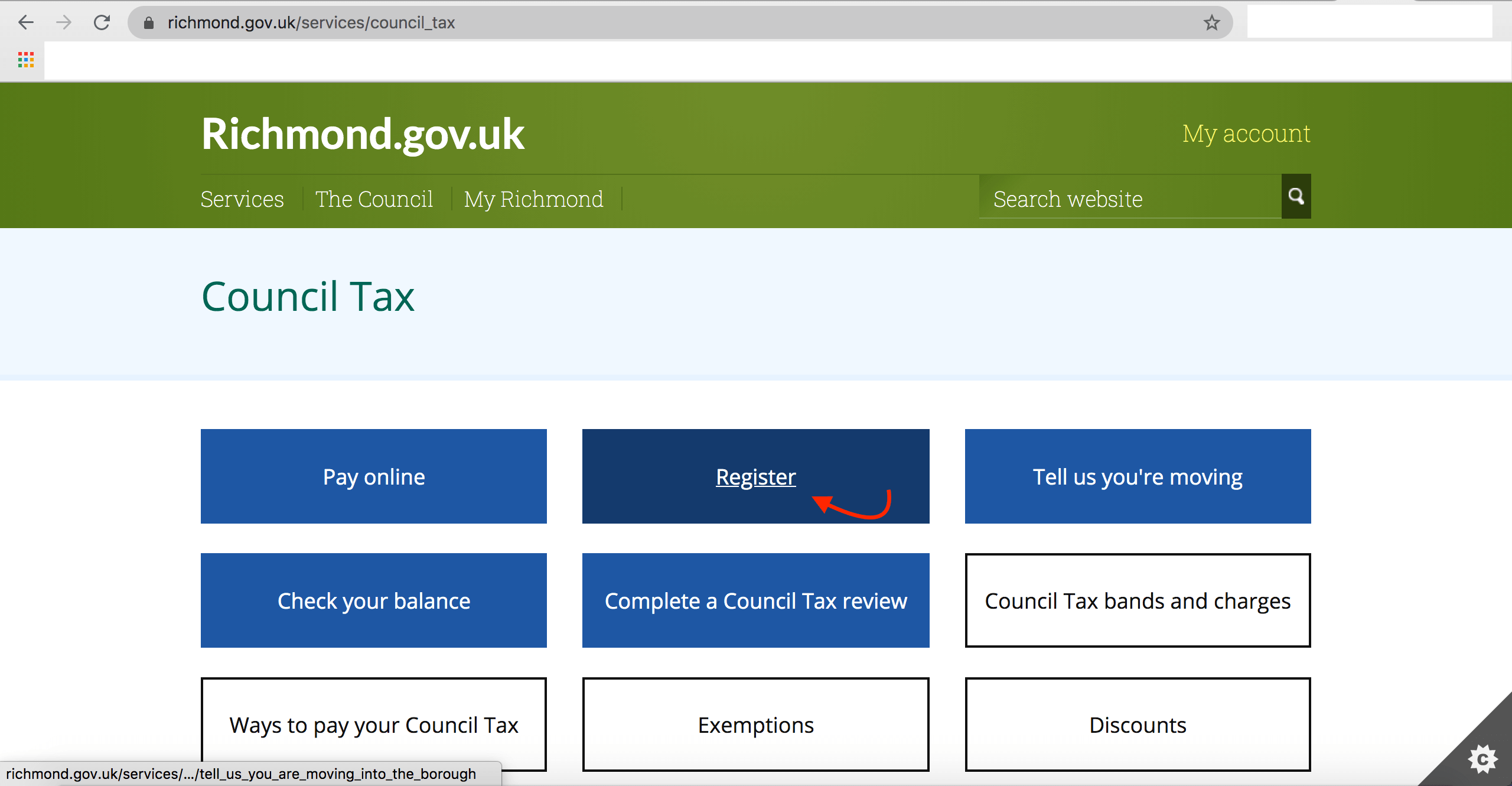

If you are moving to a new area, approach or look up Council Tax registration on the local administration’s website. Look at the example below of Richmond Council.

Council Tax Exemptions

You may be exempted from council tax if:

I. You are a full-time student

II. A person on benefits

III. Children under 18

IV. Special circumstances

For the full-list, check out the government website linked here.

Council Tax Discounts

You would be eligible for a 25% discount if:

- You live on your own

- No one else in the home is classed as an adult

- If you are looking to apply for a council tax discount, you can do so here.

- If you are given a discount by mistake, you must report this to your local council to avoid future fines.

Council Tax Bands in Scotland

I hope you find this guide helpful, good luck moving! If you are looking to keep better track of your subscriptions and bills, download Nova today to begin your financial wellness journey. Links are below, good luck! 😎

Looking to cancel your Sky broadband? This guide is just for you, take a look.