How Income Tax Works

What is taxable income?

Taxable income is simply defined as income that is applicable for personal tax.

A person who has taxable income is known as a taxpayer and the tax paid is known as income tax. Income tax is a mandatory financial fee imposed by the government on a taxpayer in a tax year to help fund government spending and public expenditure. The current tax year in the U.K. is 6th April 2020 to 5th April 2021.

The amount of income tax that needs to be paid depends on two factors:

- How much income is above your Personal Allowance

- How much of your income falls within each tax bracket

The standard Personal Allowance in the U.K. is set at £12,500. This means you will not be taxed on this amount. A Personal Allowance may increase if you claim Marriage Allowance or a Blind Person’s Allowance. Here’s an article on Marriage Allowance to learn more about it.

However, if your income is above £100,000 your Personal Allowance will decrease. For every £2 that your adjusted gross income is above £100,000, your Personal Allowance decreases by £1. This means if you earned £125,000 or more, your Personal Allowance will be zero.

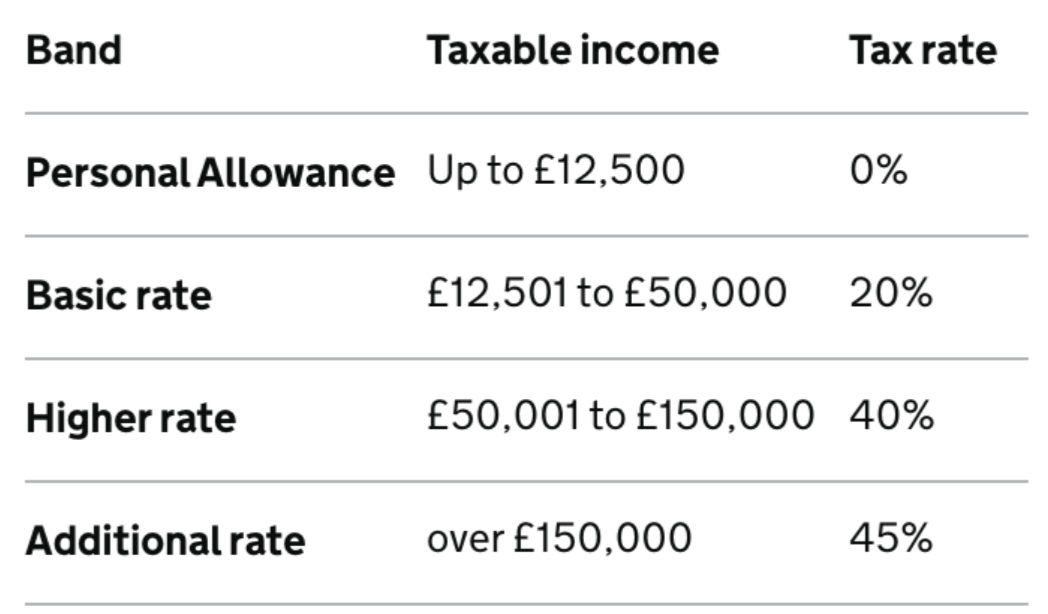

Here is a guide of the tax bands and rates by the UK Government

For example, you earn an annual salary of £20,000. You are subject to 20% of tax on £7,500 of your salary which comes to £1,500 total estimated tax paid.

If you earn an annual salary of £130,000, you are subject to 20% tax on the first £37,500 and 40% tax on the remaining £92,500 which comes to a total of £44,500.

If you earn £160,000, again, you are taxed 20% of £37,500, 40% on the following £112,500 and finally 45% on the remaining £10,000 bringing your total tax paid to £57,000

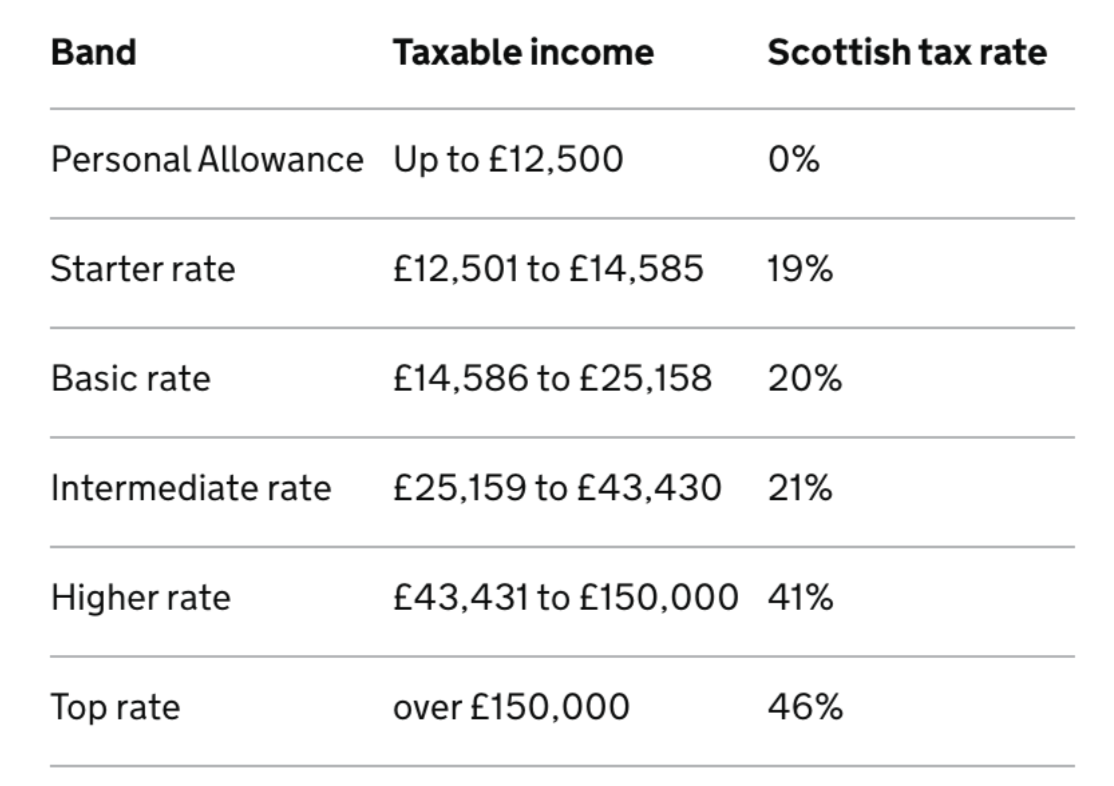

Scottish tax bands and rates are different. If you live in Scotland and/or are a taxpayer in Scotland, here is a guide for you:

The method for calculating tax is the same as the rest of the UK, so let’s work through the same examples as above.

If you earn an annual salary of £20,000. Your first £12,500 is tax free, following that, you are subject to 19% of tax on £2,085 and 20% on the remaining £5,415. Your estimated tax paid is £1,479.

If you earn an annual salary of £130,000, you are subject to 19% tax on the first £2,085, 20% on the next £10,573, 21% on £18,272 and 41% tax on the remaining £99,070 which totals £46,967 in estimated tax paid.

If you earn £160,000, again you are subject to 19% tax on the first £2,085, 20% on the next £10,573, 21% on £18,272 and 41% tax on £119,070 and 46% on the remaining £10,000 which totals £59,767 in estimated tax paid.

What is a tax return?

A tax return is a document that contains income and certain costs or personal circumstances of a taxpayer, which is used by tax authorities to calculate tax due. In the UK, a tax return is submitted either in hard or softcopy to Her Majesty’s Revenue & Customs (HMRC) annually.

Who needs to submit a tax return?

A tax return is to be submitted if in the previous tax year (April 6th to April 5th) you have met any of the following criterias:

-

Self-employed as a ‘sole trader’ and earned more than £1,000

-

A partner in a business partnership

-

Untaxed income

You can also send in a tax return if:

-

Prove you are self-employed e.g. Claim Tax-Free Childcare or Maternity Allowance

-

Claim Income Tax relief

What are examples of untaxed income?

- Rental money from renting out property

- Foreign income

- Commission & tips

- Income from savings, investments and dividends

What is a Tax Refund?

A tax refund is a tax rebate. This is issued when a taxpayer has paid for more tax than they owed.

Who is entitled to Income Tax reliefs?

Income tax reliefs apply to/when:

- Charity donations

- Pension contributions

- Maintenance payments (contributor/receiver must be born before 6th April 1935)

- Employee working at sea outside the UK

- Self-employed sole trader/partner in partnership claiming money spent running the business

- Employee using personal money for work-related expenses if they are not compensated.

Records of expenditure should be kept. A claim must be made within four years of the end of the tax year that you spent the money.

HMRC will usually make any needed adjustments through your tax code if a claim is made in the current tax year. If claims are made for past tax years (4 year limit), HMRC will make adjustments through your tax code or issue a tax refund.

Tax-free Allowances

There are tax-free allowances available to/for:

- Savings interests

- Dividends (shares owned in a company)

- Your first £1k of income from self-employment (trading allowance)

- Your first £1k of income from property rental (excludes Rent a Room Scheme)

I hope you find this guide simple and most importantly, helpful! Don’t forget to consider National Insurance too whilst you’re thinking about your Income Tax! It is a mandatory tax on earnings that goes towards the National Insurance Fund which pays for various benefits. Looking to understand this better? Stay tuned for the article on National Insurance right here at Nova.

In the meantime, take control of your personal finance and aim to improve your financial wellness with Nova! Download the app and take control of your finances. Good luck! 😎