Why we overestimate ourselves: The Dunning-Kruger effect

Photo by Scott Webb on Unsplash

In our mission to expand financial education and make you the best at smart spending, we present to you our second blog in our Money on your mind series. Sometimes the more you know the less you actually know, and believe it or not, this can harm your money management.

Overestimating ourselves is nothing new

Teenagers… They think they know everything at just 15 years old. Yet, we’ve all been one, telling (or at least wanting to tell) our parents to shut up because their lectures and opinions were wrong and outdated. At least we’ve changed since then, right?

In many ways we have, but this stereotyped, teenage mindset is part of a larger problem that affects everyone, from children to the elderly. This phenomenon is called the Dunning-Kruger Effect and can have a negative impact on your spending habits. Learning how this cognitive bias affects you is vital to saving money and may even give you a new life perspective.

What exactly is the Dunning-Kruger effect?

The Dunning-Kruger Effect occurs because people tend to overestimate their abilities or knowledge. Studies show that the majority of people will rank their skills, such as driving, healthiness, and ethics, as higher than average. By definition, we can’t all be above average, but recognizing this fact may be more difficult than it seems.

This cognitive bias is widespread and can really influence your spending habits. By assuming that you know how to efficiently budget or save money by finding the best sales, you’re already falling into the trap of the Dunning-Kruger Effect. Let’s take a deeper look into how this cognitive bias works.

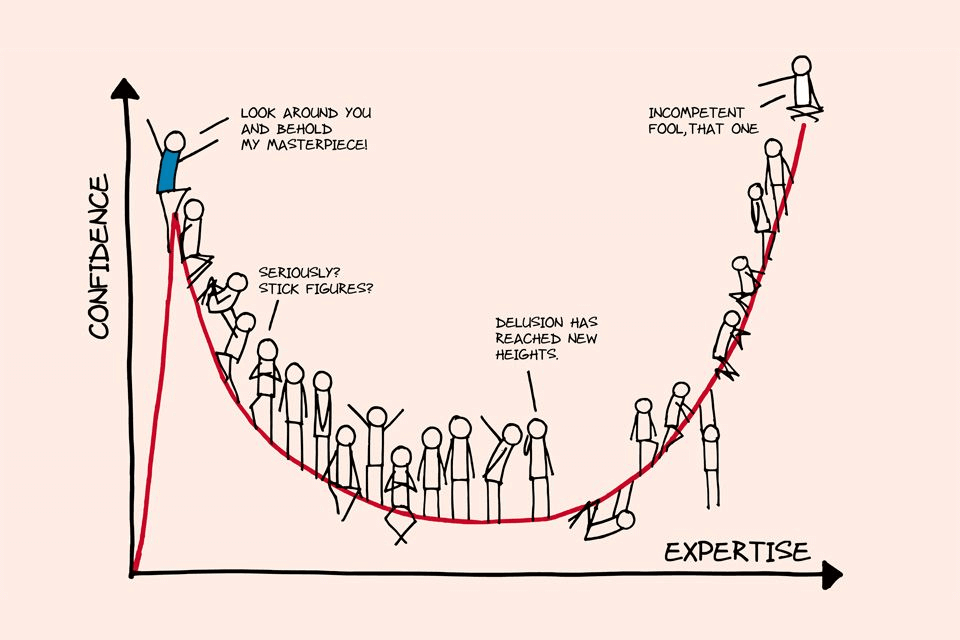

Caption: This graph of the Dunning-Kruger Effect demonstrates the convoluted relationship between competence and confidence.

Source: https://www.businesstimes.com.sg/brunch/not-so-blissful-ignorance-the-dunning-kruger-effect-at-work

Surprisingly, the Dunning-Kruger Effect shows that those with moderate knowledge of a subject rank themselves as having the least amount of knowledge. Those with moderate knowledge are able to recognize two main points that cause them to have the least amount of confidence in themselves:

- They know enough about the subject to know that they don’t know everything about the subject.

- They can identify areas of the subject where their knowledge is limited or lacking.

What about the left peak on the graph? These individuals have the least knowledge of the subject and aren’t even aware that they have so much more to learn. Simply put, people don’t know how bad they are at things because they don’t even know enough to judge their abilities. This makes them blind of how ill-informed they truly are, like a teenager ignoring their parents’ advice because they believe they know everything already.

The Dunning Kruger effect and our savings

The initial peak of the curve is where many young adults lie when first navigating their personal finances and savings. Following this curve, if you think you are great at managing your personal finances, there is a high chance that you can be doing it better. For example, if you believe that your budgeting skills are greater than average, it may be time to look at your spending habits again. Using an online tracker to see how much you are spending in categories like dining, shopping, healthcare, and travel, can help you clearly identify categories and see any patterns that cause excess spending (hint: Nova can help you with that!).

Aside from budgeting, the Dunning-Kruger Effect can influence your day to day spending choices. Even if you think you are well-informed about your purchase, it can always help to enlist the help of a friend or staff member who can offer a second opinion on your buying decisions.

Conclusion

The Dunning-Kruger Effect is an easy, but a dangerous trap to fall into. To avoid this hazard, keep an open mind and be ready to learn. Just like being a teenager, the only way to escape this phase is to experience, learn, and reflect back on your past choices. Remember: ignorance is not bliss!

If you wanna learn more about psychological effects which affect your judgement and your spending we invite you to read about Confirmation Bias

Are you looking to improve your saving skills? Nova is a gamified financial app which allows you to connect all your bank accounts, track your bills and control your spending habits. The more money you save, the higher you level up! Are you ready to start your financial journey?