How to Become Debt-Free: Christmas 2021

It’s that time of year again and Nova is here to help you out with your financial struggles! Here’s part 3 of the money saving tips series, Christmas Edition! Take a look to save your wallet this holiday season:

Tip 1 - Make a List

First thing’s first, note down what you ACTUALLY need to purchase. Not what you want to purchase, but what you need to purchase. It’s important to recognise that we can’t always have everything we desire. Thus, it’s important to sit and pen down what is truly essential for you this holiday season. From Christmas meal prepping to specifying the number of gifts needed for friends and family. Make your list of items, stick to your list of items.

Tip 2 - Create a Christmas Budget

Remember, it is important to recognise how much money you actually have, not what your credit card limit allows you. There is a difference between affording something and the false security of buying now and paying later. Calculate how much you can afford to spend, and stick to this budget.

Tip 3 - Keep Track of Your Expenses

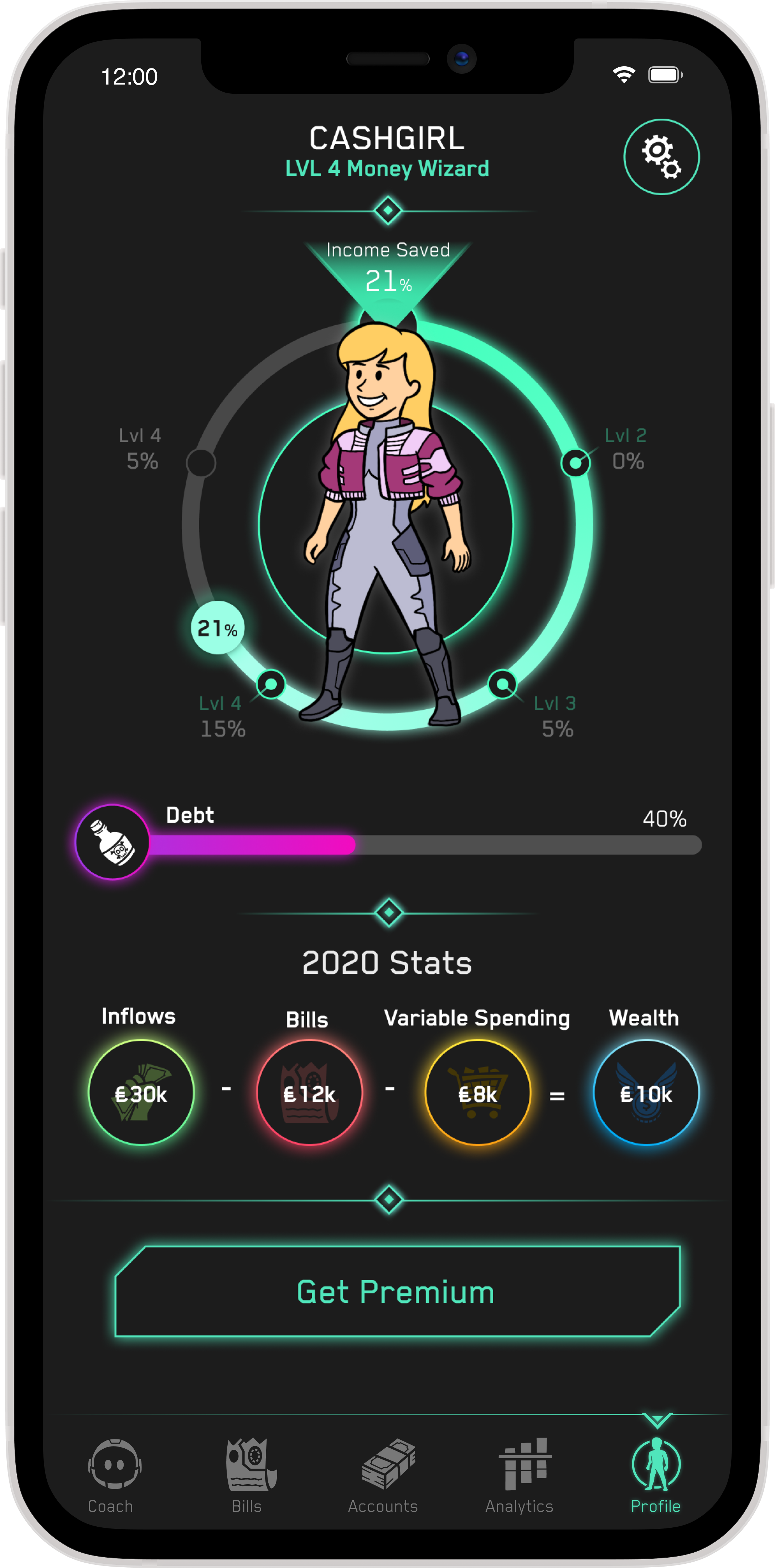

It is easy to create a budget, but it is not easy to follow through with it. If you are looking for a hassle-free and easy to understand way to keep track of your finances, look no further!

Nova is the UK’s first gamified saving app. It is catered to help millennials keep track of their finances in a fun way. Your in-app avatar levels up as you improve your spending habits. Your interactive AI-coach will help you along the way and crunch the numbers for you whilst you build wealth and kill debt in real-life! It is simple and it works. You can download it for free on both the App Store and Google Play.

Tip 4 - Avoid Buy Now Pay Later Schemes

New research has shown 2.7 million people in the UK are still paying off debt from Christmas 2019.

Buy Now, Pay Later (BNPL) schemes have been on the rise. Many people do not consider BNPL schemes as ‘real debt.’ Just like credit cards, BNPL gives people a false sense of security, deluding people into spending more than they usually would. As a result, almost inevitably, people miss payment(s) and incur unnecessary fees and implications.

Do not fall for all these pretence, and remember to only buy what you can afford to buy. Tip 2 should be your mantra.

Tip 5 - Secret Santa

Gift giving can be very fun, but it can also cost a lot of money. A Secret Santa is an arrangement by a group of individuals who exchange gifts anonymously by getting assigned a person to buy for beforehand. It is a great initiative to keep things affordable and most importantly, fun! Set a budget that everyone involved in the Secret Santa can afford. At the end of the day, everyone will receive a gift and no one loses out on a ‘lesser valued’ gift. It’s a win-win for everyone and everyone’s wallet!

Tip 6 - Christmas Potluck

With Covid Christmas restrictions, a lot of us will be gathering with our family or support bubbles in a household during this festive period. It can cost a fair bit to feed a sizeable crowd. To avoid carrying this burden alone, why not suggest a potluck Christmas meal? This way, everyone gets to bring a dish of their choice and share the cost of a gourmet family meal! If you’re looking for some meal inspirations, you can take a look at some budget recipes including a chickpea stew and roast chicken here.

Tip 7 - Carry Out Price Analysis

Brands are notorious for labelling any price reduction as a promotional price. When you come across your item of choice, try to do a comparison against other retailers in order to work out the true value of your product and make an informed decision.

You could manually do this yourself, or you could use specific websites to help you do this. Remember, Christmas Sales are not necessarily the best time to purchase something. The three websites that can help you with pricing are as follows:

- Camel Camel Camel (Amazon Only)

- PriceRunner

- PriceSpy

Tip 8 - Create Your Christmas Gifts

Sometimes forking out money to buy a gift is not feasible, so instead put in your time into making something. From curating a personalised photo book to a handcrafted Christmas card, homemade gifts almost always feel the nicest to receive. Unleash your inner Bob Ross and get creative! It not only brings joy to your recipient, but your wallet will be very happy too!

I hope these tips help you have a lovely, debt-free Christmas. Tis’ the Season to Save Money, and

a Very Wealthy New Year!