Best UK Investment Platforms for 2021

How do I choose the best investment platform?

There are lots of trading platforms aimed at different types of consumers. It’s important to choose the right one for you. Having used 21 apps over the last three months, I will be ranking the top five using the following categories:

Knowledge Level

Depending on your skill level, different apps will be either useful or useless. I will look at whether the app has educational resources and analytical features as well as usability of the app. Besides that, some apps are designed with advanced traders in mind and so the UX/UI may seem more complicated to beginners.

Customer Service

Customer service on trading apps varies greatly, some apps will only offer email support. Other apps also contain AI that will place buy and sell orders that you have chosen. It will depend on how tech savvy you are.

Investment Horizon

Are you looking for investments for retirement to help you reach your long-term goals? Do you want to focus on short-term successes? Some apps are designed to help you achieve your long-term goals. Others are based around short-term trading.

How Much Money You Have to Invest

Not only do you need to know how much money you want to invest, but you also need to consider the extra costs. Many of the apps offer commission-free trading. Some require a minimum fee for opening an account. Several apps have subscription fees. There are also fees attached to every transaction you make.

Asset Classes

What asset classes can you trade in the app? Some apps will only let you trade certain asset classes. Asset Classes are the types of assets you will be trading, e.g. stocks, bonds, crypto, currencies, commodities (e.g. oil, gold etc).

The Best Investing Platforms in the UK

1. eToro

The Best All Rounder

Etoro is a well known trading platform that has been around for the past 14 years. eToro is free to sign up for and there are no commission charges on trades. eToro also pays your UK Stamp duties as they are FCA regulated. Having your stamp duty sorted is a big bonus for beginner traders.

Another bonus of eToro is that fractional shares are available, when you start investing it may be impossible for you to buy a stock for £1000. If you don’t want to pay for a whole share eToro allows you to buy fractions of the share.

Asset Classes: eToro offers a wide range of shares, from Forex trading, to ETFs, cryptocurrencies and a number of other markets available, so you can dip your toes into different investment options.

Investment Horizon: eToro allows you to invest for both the long term and short term day trades. One downside of eToro is that you can’t take advantage of your ISA allowance, which when you’re an investor can save you a lot of money on capital gains tax in the long run.

Customer Service: eToro allows you to contact them via live chat or email. There is no 24/7 phone support. I have tested the response times of the live chat and I found it to be pretty quick. However, it does say on their website that it might take them up to 14 days to respond due to a high number of requests.

Knowledge level: As for usability, the app is well designed and easy for all levels of investors to use. One bonus is that you can communicate with other users in a chat section of the app.

A unique feature that eToro has is the ability to copy portfolios, you can select top traders and copy their trades. Copy trading is not for everyone, and you should choose who you will copy trade from wisely. Once you have chosen the person you want to copy trade, all you need to do is select the amount you want to trade and then AI does the rest for you!

Fees: eToro advertises a commission-free platform there are fees such as conversion fees, contract for difference fees, fees when you withdraw money, and even fees for not being active on the platform. You need to keep an eye out for these fees because you will be charged unnecessary fees if you’re not careful.

Even with the hidden fees, you will be getting a pretty good deal compared to other investing platforms.

2. Hargreaves Lansdown

Best Customer Service

Hargreaves Lansdown is one of the largest investment companies in the UK. This established investment platform has been providing investment services since 1981. Since the company’s conception trading has changed rapidly, let’s take a look at how Hargreaves Lansdown has adapted to modern-day investing.

Customer Service: One thing that differentiates HL from other platforms is that the customer service is excellent. Unlike many other investment platforms you can speak to a representative on the phone. Their customer service team often don’t have long wait times on calls which is handy when you are in a stressful situation.

You are able to call HL on this number:

0117 980 9984

From these times:

Monday - Friday: 8am - 5pm

Saturday: 9.30am - 12.30pm

As well as being able to call them, you can also fill in a contact form, or message them from your account.

There is some security when investing with Hargreaves Lansdown, if they went out of business you would be compensated by the Financial Services Compensation Scheme (FSCS). You would receive £85,000 of investments per person, per platform. This does not mean you will not be compensated for bad investment choices. However, this does provide some security for your investments that other platforms like eToro do not provide. Hargreaves Lansdown is FCA regulated.

Fees: Hargreaves Lansdown charges you fees for trading with their service, the fees are noted below:

Annual charges

● Annual fund charge of 0.45% on funds up to £250,000;

● 0.25% on the portion of funds between £250,000 and £1m

● 0.1% on anything between £1m and £2m

● 0% for anything above that.

Trading charges

- £5.95 - £11.95 to trade shares and investment trusts online, depending on the frequency of trades.

- Free trading for unit trusts and open-ended investment company funds.

Asset Classes: Hargreaves Lansdown offers a range of over 3500 funds, ETFs, investment trusts, bonds etc.

Investment Horizon: Hargreaves Lansdown is suited for long-term investments as you are able to invest in a variety of bonds, ETFs and other funds.

Knowledge level: The app has an easy-to-use interface, and several levels of login security. As well as a good interface, HL provided you with a range of calculators including a pension calculator and an ISA calculator.

3. Nutmeg

Best Ethical Investment Platform

Nutmeg is a newer investment platform that was founded in 2011, it is cheaper than other platforms and was designed with a young investor in mind. Let’s have a look at how they do with our criteria…

Customer Service: Nutmeg offers a range of contact options, you can contact them on nutmail is - a secure inbox where you can ask any questions from your account. Nutmail is only available on the website not in the app.

You can email them at: support@nutmeg.com

You can also call them on : 020 3598 1515

From Monday – Thursday 9am – 5.30pm

Friday 9am - 4.30pm

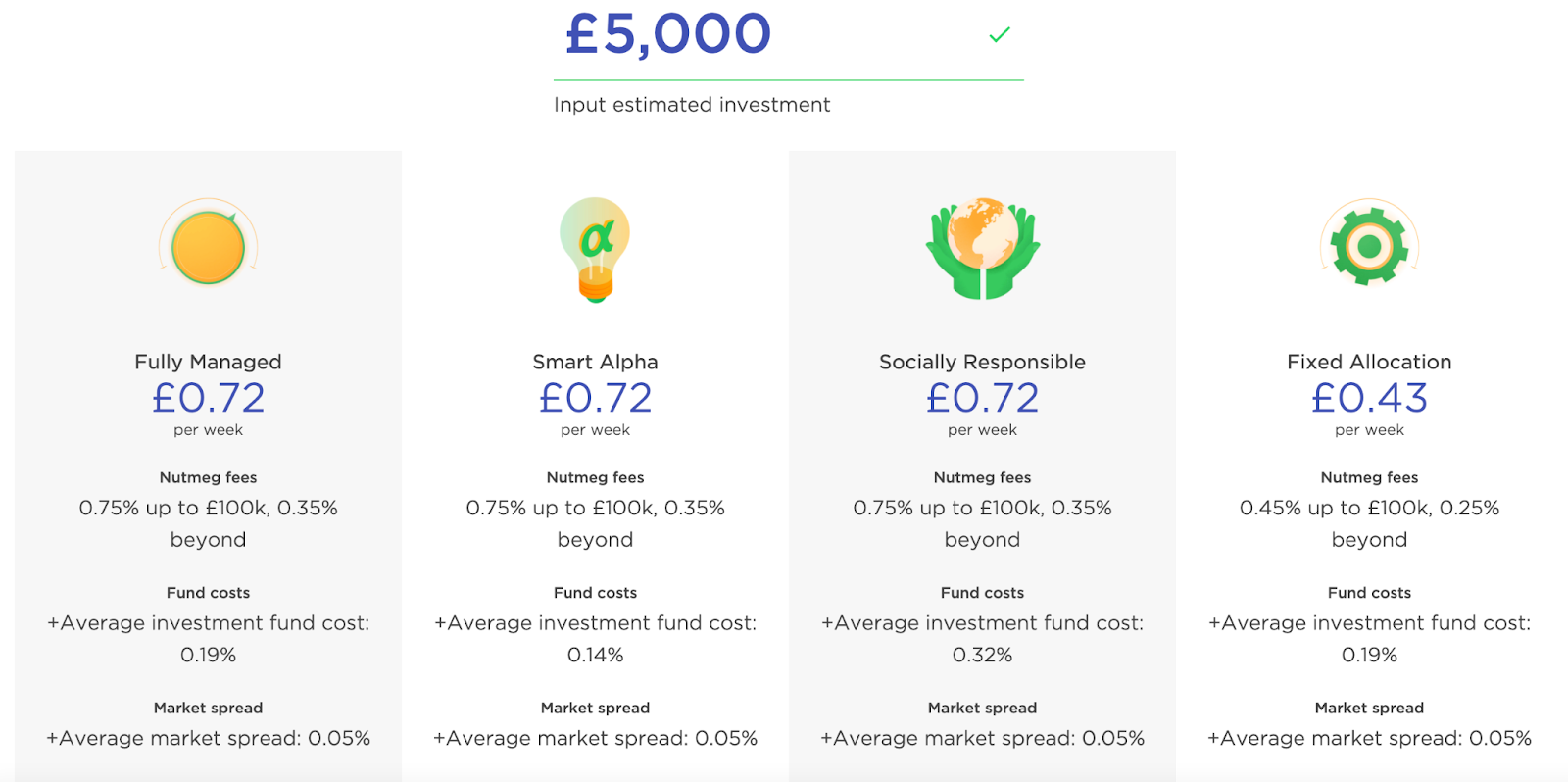

Fees: Nutmeg allows you to see the potential fees on a sliding scale, you can input your estimated investment amount and see your fees. There is a minimum amount you have to invest of £500, for a junior ISA and a lifetime ISA the minimum investment amount is £100.

For those who are worried about protecting their investments, Nutmeg is covered by the Financial Services Compensation Scheme (FSCS). Nutmeg is also FCA regulated.

Knowledge level: Nutmeg is excellent for those who don’t have the time or knowledge to make informed decisions when it comes to investing. Nutmeg provides you with a variety of portfolios that take the pressure off of consumers to make decisions.

Asset Management: Nutmeg has a range of managed portfolios which vary in risk level. Each portfolio has a number of assets, investments and industries. Nutmeg encourages its users to invest in a number of ETFs in order to be more risk averse.

Nutmeg provides you with options for socially responsible portfolios, if ethical investing is your thing, you should have a look at the 10 portfolios available for more socially conscious consumers.

Investment Horizon: Long-term investments, Nutmeg’s whole ethos revolves around long-term investments. Nutmeg argues that using a globally diversified portfolio will outperform any hand-picked stocks or day-trading profits.

4. IG

Best Day Trading option

IG is an app used worldwide, with a plethora of trading tools including the IG academy as well as being regulated by the FCA and compensation from the FSCS what’s not to love?

Customer Service: IG allows you to call them on the phone, they also encourage you to tweet or email them with any problems.

Tweet: @IGClientHelp

Email: helpdesk.uk@ig.com

Call: 0800 409 6789 or +44 20 7896 0079

Fees: IG has the cheapest rates of all brokers that offer ISA and SIPP, the fees are below:

- 0-2 trades (in one month), you will be charged £8 per trade for non US shares

- 3+ trades (in one month), you will be charged £3 per trade for non US shares

- 0-2 trades (in one month), you will be charged £10 per trade for US shares

- 3+ trades (in one month), you will be charged £0 per trade for US shares

IG has no minimum deposit for bank transfers, but there is a minimum deposit for credit/debit cards and for PayPal. The minimum deposit is only $300 for debit/credit cards or PayPal.

Asset Management: IG has a large selection of options including: Forex, Indices, Shares, Commodities, Cryptocurrencies, Bonds, ETFs, Options etc.

Investment Horizon: Both long term and short term investing can be done using IG, you can invest in your ISA using IG and so it may be of interest to those looking to save a little money when investing.

Knowledge level: IG offers a lot of technical analysis including html5 charts, numerous technical indicators and drawing tools. The app has great usability, and can be used by all levels of investors. IG also offers you ways to invest for retirement through a variety of ETFs and portfolios curated by IG.

5. Degiro

Best for Low Costs

Degiro is the ideal account if you want to avoid those pesky fees from trading accounts, but there are some downsides for the price you pay. Let’s take a look at the advantages and disadvantages of Degiro:

Customer Service:

If you want to contact customer service you can do so on this number: +31 20 261 3072 The phone line is open weekdays from 7am to 9pm. Though call service is available the wait time can be long, this is due to COVID limiting capacity of workers and an influx of new traders. DEGIRO encourages you to contact them via email on clients@degiro.co.uk.

Fees For Shares:

Degiro has the lowest fees around, at least in the UK. There are a few fees you will need to consider.

- For UK shares, the cost per trade £1.75 + 0.014% per share capped at £5.00.

- For US markets, the cost per trade is €0.50 + USD 0.004 per share, there is no cap.

- For European markets, there is a range of potential charges from €2.00 + 0.118% up to €10.00 + .0168%.

- Annual fee for all trades not on the LSE is €2.50, so a very small charges

Fees for trading funds: These fees can be as low as €7.50 plus 0.10% up to €75.00 plus 0.10%. The annual charge for holding funds is 0.2%.

There are also other fees in order to access market data in real time, you will need to pay €2.50 up to €10.00 a month. Their minimum deposit to open an account is £0.01, so it’s easy to open up an account with little to no money.

Investment Horizon: This app is more suited to day traders or traders who are just playing around with a bit of spare cash. Degiro does not allow you to open an ISA account, so there is no

Knowledge level: There are some cons that come with such cheap prices, there is no educational content or fundamental research that is provided by other brokers such as HL. For advanced traders who want to avoid high fees DEGIRO is for you.

Asset Management: If you are only going to be trading stocks, DEGIRO is the best option for you. There is a limited amount of ETFs and portfolios.

Nova

When taking control of your money the first place you need to start is looking at your income and your spending habits. If you are looking for a fun way to keep track of your finances, look no further. Nova is a free replacement to boring budgeting tools, expensive financial planners and traditional piggy banks!

We believe personal finance should not be complicated by jargon, instead be made simple and fun for our generation. We strongly advocate financial literacy and believe financial education is for everyone.

Nova also has a new social aspect where you can connect with friends and support each other on your financial journey.

Common FAQs

What is an ISA?

In the article I’ve mentioned an ISA multiple times, an ISA is an Individual Savings account in which any profit made off of your investments is tax-free. For this tax year 2020/2021 is £20,000, there are multiple types of ISAs if you want to see a breakdown of different ISAs you can go to this blog.

How can I invest smartly?

This is a difficult question to answer, the best solution is to have a diversified portfolio. Having some money invested in different stock options

One thing that is important to invest smartly is to have money set aside for rainy days. You don’t want to be forced to sell your investments at a bad time because you can’t afford to pay for your living expenses.

How much should I invest?

Before you start investing you should always have an emergency fund of around 3-6 months of living expenses saved up. As well as an emergency fund you should have paid off any high-interest debt e.g. credit card debt. If you need any advice on how to pay off credit card debt go here.

How much you invest depends on a number of factors including your age, financial goals and your income level.

Set Your Financial Goals

What are you investing for? Depending on what you are investing for you will need to see how much risk you are willing to take. Once you have your goals in mind, you will be able to see how much money you will need to save/invest to reach your goals.

Create a Spending Plan

Now that you have your financial goals you will want to manage your spending. The easiest way to invest more is to save more. You can use Nova to track your spending and see how much you can put aside for investing. Most people use a percentage of their income as their goal for investing.

Invest According to Risk Profile

Age and income are key factors here, if you don’t have a lot of money/income or are only interested in short-term goals you may not want to put your money in very risky investments.

If you are investing to save up for a down payment on a house or are retiring soon, you may want to invest in low-risk investments e.g. ETFs.

If you are investing for the long term (10+ years) you may want to invest in a mixture of bonds, ETFs and high-risk stocks. Having a diversified portfolio allows you to be more risk averse, it’s never good to put all your eggs in one basket.

No matter how you invest you should always have a diversified portfolio, I cannot stress this enough. Having a diversified portfolio is very important, yes you may lose out on big stock investments but putting your eggs into one basket can cause a bigger loss.