Improving mental health and financial stress

https://unsplash.com/photos/BSvRfFDCO7U

This is Part 7 in our Money in your mind blog series. We are here to help expand financial education and make you the best at saving money. We all know money gives stress, anxiety and other negative emotions. How exactly can you deal with these and start to overcome them?

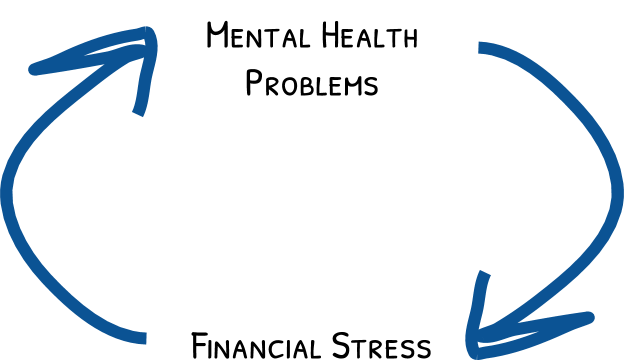

The toxic cycle between mental health affecting stressful financial management poses the classic “the chicken or the egg” situation. The majority of UK citizens are worried about their mental health being affected by financial stressors and over two thirds are concerned about a friend or family member having this same issue.

The bottom line is mental health and financial stress are normal issues and knowing how these affect each other can help you tackle them.

The connection between mental health and financial stress

Experiencing mental health problems can make it harder to do everyday tasks, especially ones involving money.

Mental health can make it even more difficult to control habits dealing with impulsivity and memory. These can include paying bills, impulse spending, tracking expenses, and making other large financial decisions. Additionally, 3 out of 4 people struggling with mental health find it difficult to engage in discussions about their finances in person and through the phone.

On the flip side, financial stress from struggles like debt and paying bills on time can lead to mental health problems. Debt is heavily stigmatized and can often be uncomfortable to discuss, even with close family and friends. Worrying if you are able to afford necessities, like rent, food, and utilities, can be extremely conducive to anxiety and feeling helpless. Financial struggles can often make people feel isolated, anxious or helpless, as well as increase stress.

Advice on improving your mental health despite financial stress

https://unsplash.com/photos/hluOJZjLVXc

Being aware of the common effects of mental health on financial stress and vice versa can help you combat them.

- Reset your mindset.

a. Consider consistently saving up as a way to maintain control and be prepared for hurdles that come your way. - Start small.

a. Spending just 5 minutes a day to check-in and learn about your finances can turn your stress into more manageable bits. - Opening up about finances.

a. Discussing with a professional financial advisor or trusted family and friends can help you stay on track and feel less alone, even in times of stress. - Create personalised budgets

a. Making realistic budgets that still give you room to be happy and indulge in items that will make it easier to stick with can help you stay on track. - Talk with a therapist.

a. There are many low-cost resources for advisors, either in your area or online. Opening up about your stress to a professional can help with specific and personalized advice. - Use Nova

a. Seriously, being in control of your finance is the best way to break the vicious cycle of mental and financial stress. That’s why we created Cash Coch so start your finacial journey - now!