5 Tips to Manage Student Loan Debt During Covid-19

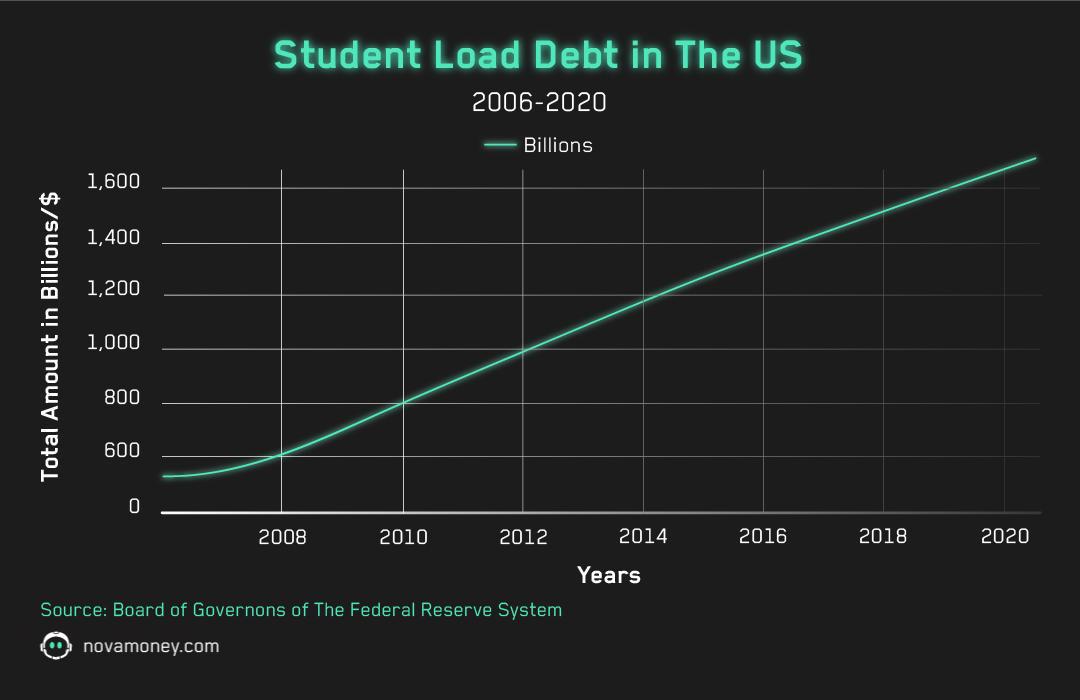

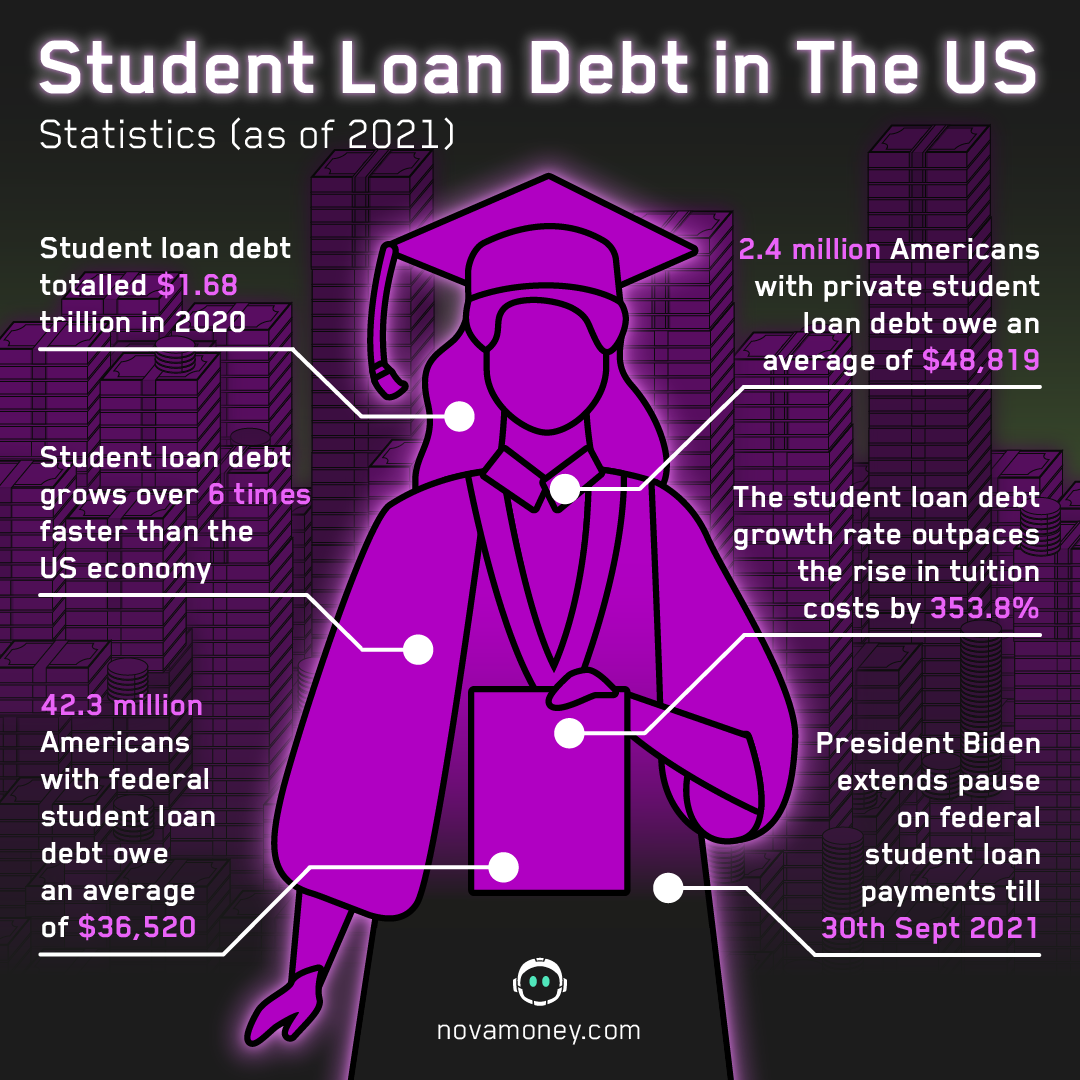

In 2020, student loan debt totalled $1.68 trillion in the US. It is said that student loan debt grows over six times faster than the US economy. That’s crazy!

Whilst the extended interest-free suspension on federal student loan payments till 30th September 2021 may be comforting to many, it is not a solution, it is delaying the inevitable outcome.

If you are one of many Americans currently struggling with your finances because of Covid-19 and you are looking to manage your student loan debt, look no further. This guide is tailored to help you understand your stand with student loans, the options you have and learning how to manage your debt going forward.

Federal Student Loans vs Private Student Loans

What is a Federal Student Loan?

These are loans made by the government, which include many benefits such as fixed interest rates and income-driven repayment plans with terms and conditions that are set by law.

Under the CARES Act, these loans have been suspended interest-free till 30th September 2021 by President Biden. There are some exceptions to this such as the FFEL and HEAL schemes. If you are looking to determine if you have a federal loan, you can do so by accessing the National Student Loan Data System (NSLDS) here. Log into this site by using your FSA ID. Sign in and click on ‘View Details.’ Next, scroll down to ‘Loan Breakdown.’ If your loan is labelled with the ‘DEPT OF ED,’ your loan qualifies for the student loan pause.

Unlike private loans, federal student loans are discharged once you pass away.

What is a Private Student Loan?

These loans are offered by banks, credit unions, state loan programs or non-federal institutions. Anything from a loan by PNC to one offered by your university is a private loan.

Unfortunately, due to the nature of your loan, you are not eligible for the Covid-19 relief provided by the government as it only applies to federal student loans.

If you are struggling with your private student loan, I suggest contacting your lender and exploring the relief programs offered. The majority of lenders provide forbearance. Similar to the pause on a federal student loan, forbearance indicates your loan payments are put on hold and postponed for a period of time. For Covid-19 relief schemes, this period is usually three months.

However, take not that interest will continue to accrue during forbearance. It won’t capitalize in most cases.

Unlike federal student loans, private loans are considered a part of your estate and even once deceased, your loans will need to be paid for.

Measures You Can Take

1. Refinance Your Private Loans

Refinancing your student loans entails replacing your existing student loan with a new one that pays off the debt of the first student loan. With interest rates being so low (Fed Interest Rate= 0.25%) at the moment, it may be in your best interest to refinance your private student loans if you have high-interest rate loans.

The benefits of refinancing your private loans is you can lower your monthly payments as well as your interest. Take note however, refinancing can extend the period of your loan as you are taking out another loan. Avoid extending your loan period. This is because this can add up a lot more money to your already existent debt over time.

2. Paying Off Your Federal Student Loans Anyway

Whilst the payment pause is in effect through September 2021, borrowers can still make payments to lower their debt during this period of forbearance.

The 0% interest period will really allow you to get ahead of your debt. If there is a possibility of making payments right now without eating into your savings or emergency fund, you may want to carry on with paying off your federal student loans. However, if you have a high interest consumer debt or do not have enough to make ends meet, you may be better off using this forbearance period to get the rest of your finances in order.

If the options above are not feasible, you can try the following:

3. Creating a Budget

Once you have figured out and have a better understanding of your debt, you need to work out how much you need to save monthly to pay off your debt.

A spreadsheet gives you autonomy to customise it to your needs and goals. It is simple and it works.

However, if you are not a fan of spreadsheets and cannot bring yourself to compute the numbers, you will love Nova! It is the only financial app catered to help millennials keep track of their finances whilst having fun. They crunch the numbers for you whilst you reach your financial goals one objective line at a time! It is simple and it works. To be the first to know when the app launches in your respective country, please join the waiting list here.

4. Make Lifestyle Changes

If you have spent more than you earn in the last six months, you are in dire need of a lifestyle revamp.

Your finances need a detox and your habits need some financial discipline. It’s time to track down unused subscriptions and unwanted direct debits. Cancel your Klarna account and chuck away your credit cards!

You may be still paying for a mobile number from your past that you no longer use - be sure to cancel this payment and save as much as you can. If you are no longer heavily using your car and are not in need of using it for a long time, you may want to consider cancelling your car tax to save some money. The aim of the game is to reduce your variable costs and save as much as you can.

This may be one of the hardest steps for you if you are already making dramatic cuts to your expenses. However, there are probably some blindspots you may be able to address. Take a look at some of these money saving tips to check if you are already practicing these tips:

5. Aim to Increase Income

Side hustling has become the norm for many during the pandemic. This is especially the case in the food-delivery industry. Companies such as UberEats, Postmates and Instacart have been hiring new pick-up/delivery drivers to keep up with the spike in demand. It is said that drivers earn between $15-$20 per hour. According to a report, Wednesdays, Thursday and Sundays are some of the highest paying days. If you have some spare time and are looking to increase your income, this is an option to consider.

Besides food deliveries, peer-to-peer car rentals have become increasingly popular. If you are currently working from home and are not using your car much, you could earn some income from this. Platforms such as Turo, HyreCar and Getaround allow you to list your car for rental and set your own rates. Renters may rent your vehicle for personal or work usage. For example, someone who doesn’t have a car, looking to side hustle via Postmates can rent your car to do so.

Don’t worry, your car is covered by a $1 million insurance policy, and car owners can make between $15-$30 on a daily basis by renting out their car(s).

Remember, there are options for all kinds of loans. Whilst federal borrowers may have a slight advantage over private borrowers, the latter still have options depending on their lenders.

Start looking at your budget and figure out what works for you. There’s always a way to increase your income and reduce your expenses. As the saying goes, “When there’s a will, there’s a way.”

If you are looking for a job, there are a ton of vacancies for students that you can find on the Internet. For example, sites like Jooble offer help to students looking for jobs.

Remember, if you save money now, money will save you later. Download Nova now for an easy and free tool to help you on your journey of financial freedom. We are here to help you kill debt and build wealth, one step at a time.