5 Steps to Financial Freedom

How do you become financially free?

First you need to understand what financial freedom is:

Financial freedom is taking full ownership of your finances. You do not need to rely on anyone, worry about your bills or unexpected expenses. Riding the wave of a financial crisis doesn’t make you sweat and you are not burdened by debt.

You have a dependable source of income or cash flow that enables you to live life the way you want.

How do you get there? Here are the top 5 rules to become financially free:

Understand where you currently stand

Where else to start but ground zero. You need to understand both your inflow and outflow of cash. You need to understand how much you make and how much you spend!

Money IN - Money OUT = Money Saved

How much you earn - costs incurred = Your Profits

Once you get the picture, you’re ready to move on to the next step - writing down your goals.

List Your Goals

Why do you need the money? Is your goal to pay off all your debt? Do you want to escape the 9 to 5 grind? Are you looking to travel? Maybe you are saving up for your wedding or you’re just planning for retirement.

It’s important to have a goal in mind to have the motivation to save for your specific targets. This is where knowing your numbers comes in handy. Why? Because you need a certain amount of money for a future date. If you know how much you can save a month, all you have to do is follow this formula:

Goal Amount/ Time You Have = Required Monthly Saving

If you’re struggling to figure out your numbers and plan a goal, no worries! Nova is here to help you on your financial journey. Connect all your bank accounts, tell Nova what your goals are and let Nova tell you when you can realistically achieve them.

You can even set a priority rank to distinguish which goal you would like to achieve first. For example, I’m looking to get married in Spring 2023 and I would like to prioritise that over owning a bigger home.

Once you have completed this step, you’re ready to put your plan in motion!

Budget

Budgeting involves both step 1 and step 2. It consists of planning your monthly income and expenses in order to make sure you actually meet your savings goals. You will need to look at your current month and project:

- How much you will earn

- Minus how much you will need to pay in bills

- Minus how much you will need to save for your financial goals

This will help you understand how much you can safely spend for the month.

Build Your Money Mindset

Your money mindset is the difference between living paycheck to paycheck and living financially free. It’s important to look at money as a tool that will help you achieve your financial goals and help you live a stress-free life. Budgeting doesn’t mean you won’t have fun - it just means you have planned for fun! Look at it as delayed gratification, not instant gratification. Like investing, you should be in it for the long-run if you are looking to yield high profits…which brings me to my final point.

Invest

Unlike what most people believe, you do not need to know anything about the financial markets to make money through investing.

Secret: Invest in exchange-traded funds (ETF) and become a millionaire.

ETF? An ETF is essentially an investment fund that trades on an exchange, like a stock. It basically replicates the performance of a stock market like NASDAQ, FTSE 100 or anything else. Investing in ETFs is simple, diversified, and beats 99% of the investment strategies carried out by humans.

ETFs trade similarly to stocks, however they greatly resemble mutual and index funds. Let’s look at an example of how an ETF will increase your net-worth in the long-run.

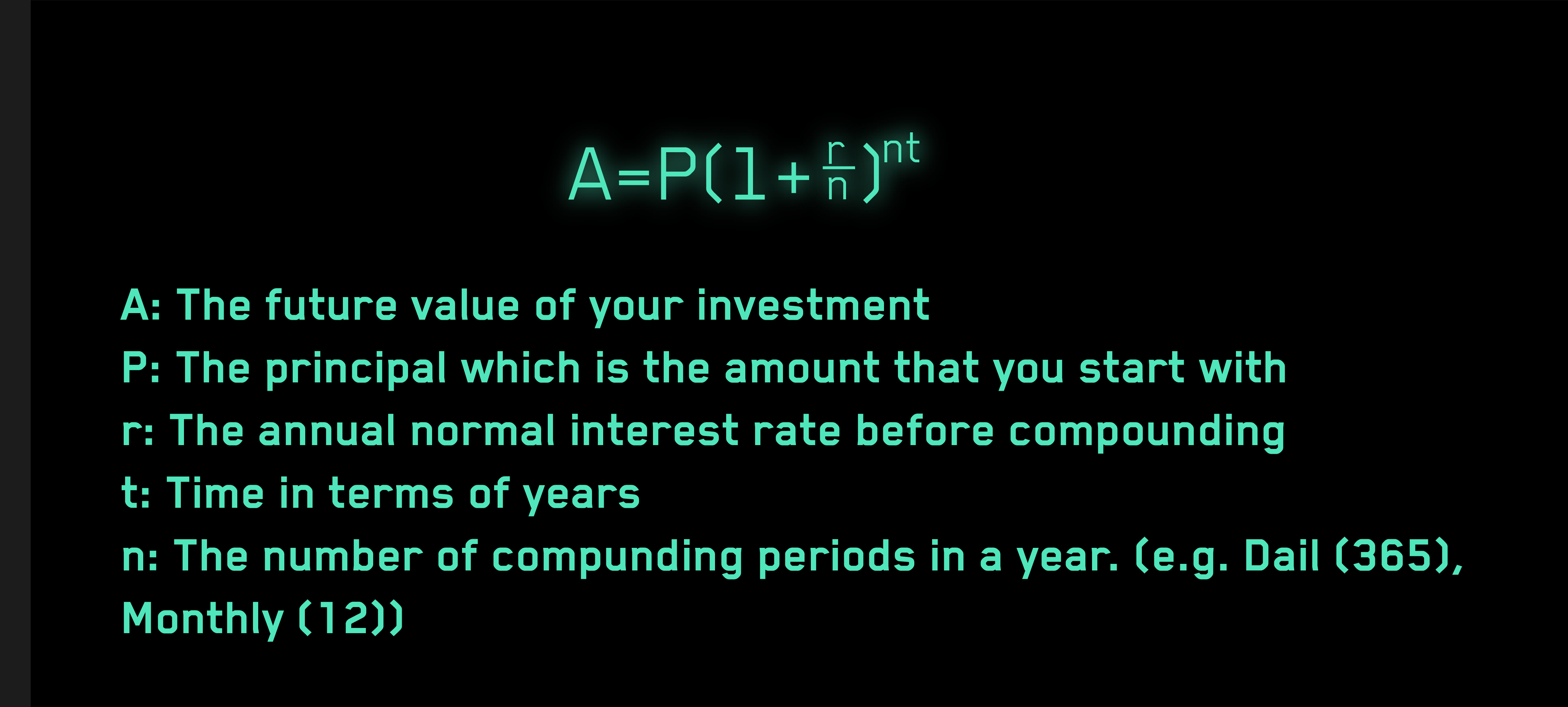

Your return on investment is based on compounding interest. It can be calculated using the following formula:

To quote Albert Einstein, “Compound interest is the eighth wonder of the world. He who understands it, earns it; he who doesn’t, pays it.” Since 1962, the S&P 500 has averaged a yearly return of 10% since 1962. If you invest £500, £700 or £1000 monthly into an ETF that mirrors the S&P 500 you will have:

The graph above shows how each amount grows exponentially. Assuming a 10% annual return, if you invest £500 monthly, you will make over a million pounds in 30 years. If you invest £700, you will make over a million in 27 years and if you invest £1000, you will make over a million in 23 years.

As you can see, the recipe to attaining financial freedom is quite simple. It’s a matter of adopting good habits, understanding your objectives and building your money mindset.

The hard part is to develop and keep up with good habits because the temptation to spend is always more appealing in the short term. Don’t forget to download Nova today to start your journey - it’s FREE!