Cognitive Biases: Availability Heuristic and Your Spending

Photo by Jordan Sanchez on Unsplash

This is Part 11 of the series Money on Your Mind, a blog series created to expand financial education and help you understand how your brain can affect your money management. Do you know the saying ‘It’s all about perspective’? Well, let’s talk about how cognitive biases like Availability Heuristic can impact or perception and spending habits.

What are cognitive biases?

Cognitive Biases are different ways in which our perception, judgement or decision making can be influenced unconsciously. This often occurs, as you may have guessed, thanks to our cognitive system and generally these biases can make us drift away from rational objectivity.

For example, When I was in high school, I commuted every day either driving or taking the bus. Now, I fly just 4 times a year to get to university and always find myself getting nervous as the plane gets ready to take off.

As the plane speeds up on the runway, the entire cabin rattles. My mind instantly interprets these sensory inputs and reminds me of the most recent plane crashes I’ve seen on the news.

Yet, the chance of dying in a car crash is 1 in 114 (or probably a bit more if I’m the one driving), compared to 1 in 9,821 for air travel. To put it another way, you are over 86 times more likely to die when you are driving than when you are flying. So why do I, and many others, often get more anxious about flying than travelling in automobiles?

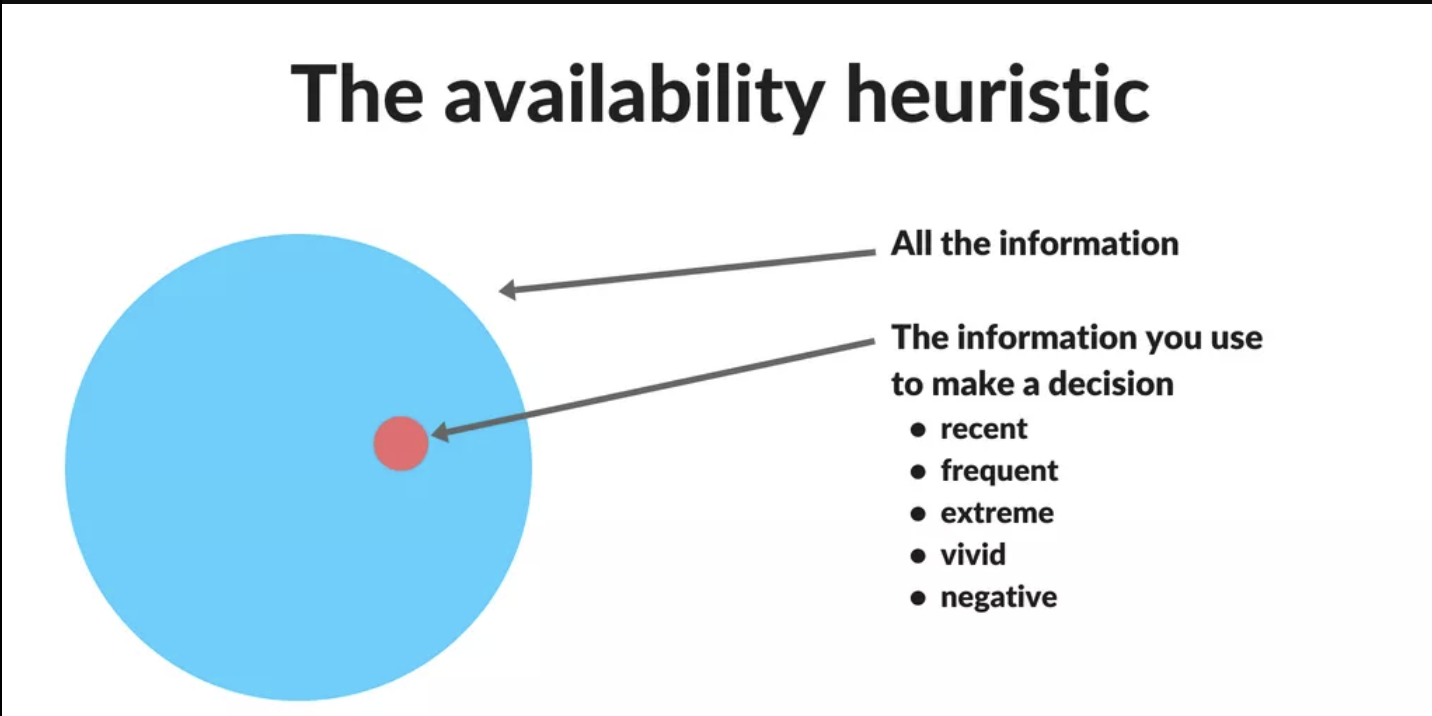

This phenomenon can be explained by a cognitive bias known as the Availability Heuristic, a mental shortcut that causes us to rely on the information that comes to our minds the fastest. In other words, we place the most weight and value on the information that we think of first, which can make us inaccurately estimate the likelihood of events that could actually occur.

How Does Availability Heuristic affect our perception

We rely on our memory to make everyday decisions, like choosing the fastest route, recalling the hottest topics in the news, and of course pressing the Netflix button without even realising it. However, our brains aren’t computers. We have an easier time remembering and retrieving information that has the strongest emotional impact on us, rather than the most realistic details. The picture above looks at some of the factors that cause information to make strong impressions in our minds.

Photo by Wan San Yip on Unsplash

Let’s look at an example to see how well negative information sticks in our minds. When was the last time you’ve embarrassed yourself in front of many people? If you’ve ever been embarrassed in front of other people (I mean, who hasn’t?), every time you’re put in the spotlight, your memory will probably cut straight to that time you made a fool of yourself and convince you that you don’t do well with a crowd watching.

Money Biases: Our Spending and Availability Heuristic:

Similarly to the plane scenario, your brain automatically jumps to conclusions when it comes to money. Money and personal finance can be highly emotional topics.

If you’ve had bad experiences with money, such as credit card debt, maxing out credit cards, and taking out loans, you’re more likely to frequently recall the feeling of confusion or helplessness when dealing with money in the long run. Since your mind brings up these scarring examples first, you’re not likely to recall the months where your budget did go accordingly or times when you were able to cut $15 off your grocery bill from the coupons you’ve meticulously collected. The Availability Heuristic helps you convince yourself that you are bad at managing your money and can leave you stuck in a cycle where you may feel incapable of helping yourself.

More commonly, marketing takes advantage of the Availability Heuristic. Ads typically aim to create a strong association with specific characteristics to the brand or product itself. This way, when the brand name is mentioned, people quickly think of a few characteristics that the brand highlights about itself.

For example, Dawn’s slogan for their dish soap is “tough on grease, gentle on hands.” This creates an association of Dawn’s soap as gentle, but effective. When looking to buy dish soap, your mind might remember that Dawn won’t dry out your hands and decide to buy it when there may be an equivalently gentle alternative. Going for these brand names can often cost you more money than if you buy a no-name brand.

It’s important to remember that recalling these negative outcomes with money first does not mean that they are most likely or frequent experiences that you can have with money. There is always time to learn from your mistakes, rather than shy away from them. As always, taking the time to research your purchases instead of impulse buying at the supermarket can save you money.

One of the best practices I’ve used for my spending is setting and tracking monthly challenges for myself. Even though I do remember my failures, I remind myself that this process will make me better at saving in the long run. Plus, looking at my past months, I can see and remind myself of any successes I do make to retrain my brain to celebrate my progress. Take your experiences in stride and get ready to apply these lessons moving forward to make both you and your wallet happy.

If you want to learn more about other Cognitive Biases which influence spending habits we invite you to read the rest of our Money on Your Mind series!