Panic Buying, your Finances and why it's a problem

Photo by Jeffrey Hamilton on Unsplash

This is Part 4 of the series Money on Your Mind, a blog series created to tell you exactly what you need to know about your brain and your spending habits in a straightforward, simple format.

It sounds ridiculous that billions of nuts have been collected, buried, and forgotten by squirrels around the world. While hoarding these nuts is essential to a squirrel’s survival throughout the winter, forgotten nuts are wasted. Just like these excess forgotten nuts, products of panic buying are often wasted and buying them wastes our precious resources and time.

What is panic buying?

Yet, it’s not entirely our fault for panic buying and potentially wasting our money on items we don’t necessarily need. In times of stress, such as natural disasters and the ongoing COVID-19 pandemic, it’s natural for our brains to go into overdrive and activate a fight or flight response.

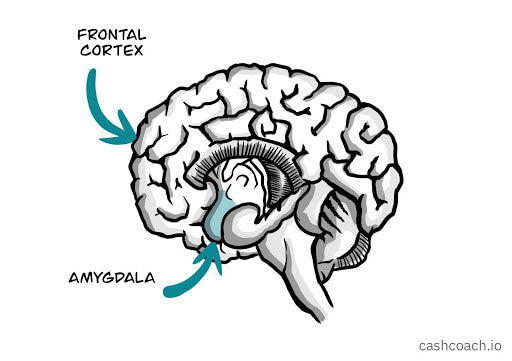

Here’s what happens. There are two vital parts of our brain we should know to understand our thinking:

- Frontal Cortex - the rational thinking center

- Amygdala - the emotional control center

Let’s say you’re at a supermarket and you see your ex you just broke up with a week ago walking towards you. Your frontal cortex will tell you to just act natural and say hi, while your amygdala will tell you to turn around and get out of there in any way possible. With all the other quick scenarios your brain is thinking through, your rational frontal cortex gets confused. Fear causes your emotional amygdala to take over with a surge of adrenaline. This quick reaction can save lives in many situations, but long-term problems require the rational side of a brain to think through the risk and options and create a methodic response.

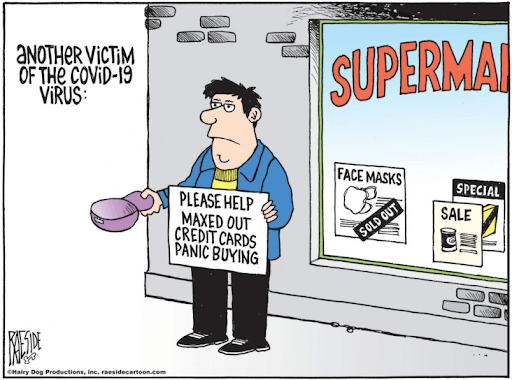

In the face of COVID-19, panic buying makes sense. People want to stock up on their essentials due to the great uncertainty in the length of the pandemic. The “bandwagon effect” also can kick in where you may feel that panic buying is necessary since everyone else seems to be doing it. Either way, panic buying gives us at least one thing we can control and be prepared for in unexpected and unprecedented times.

https://www.burnabynow.com/news/adrian-raeside-cartoon-going-on-a-panic-buying-spree-1.24089878

How does panic buying affect your spending?

Panic buying is essentially an unplanned shopping spree, filling your cart to the brim to stock up your pantry. Your budget likely does not account for your choice to buy 20 bottles of hand sanitizer, instead of the 2 you might normally buy on a trip to the store. Additionally, you’re more likely to buy a can of SPAM simply because it’s available and has a long shelf life (even though we all know no one really likes SPAM). Even in a pandemic, you’re still not likely to eat that can of SPAM, which ends up being a waste of money. Following Sunk Cost Fallacy, you’ll likely buy even more items you don’t necessarily need because you’ll feel the need to make the hour you spent waiting in line to get into the store worth it. If you’re on a tight budget, one large pandemic shopping spree can add to credit card debt and make it difficult to get back on track with your savings plan.

It’s hard to override this instinctual, fear-driven, fight or flight response of panic buying. Yet, reminding yourselves of the severity of the consequences panic buying can have on your savings and sticking with a planned, realistic shopping list is a great way to stay on track.

Want to gain more insight into the brain chemicals which influence your spending habits? Learn about ***4 important brain chemicals ***which influence your spending.